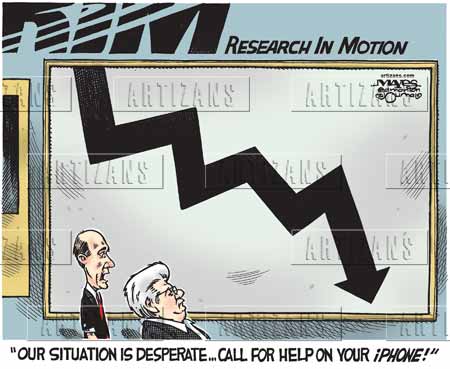

Breaking: RIM Hires J.P. Morgan & RBC To Develop A “Strategic Review”, Sale Of RIM Is Possible

This afternoon Research in Motion (RIM) released a press release stating that the company has hired J.P. Morgan Securities and RBC Capital Markets to assist in creating a “strategic review”.

This news comes as the company is about to lay off upwards of 3,000 employees and is struggling to manage over $1 billion in unsold inventory.

Thorsten Heins, RIM’s CEO, had this to say:

In terms of challenges, as I mentioned on the March financial results conference call, RIM is going through a significant transformation as we move towards the BlackBerry 10 launch, and our financial performance will continue to be challenging for the next few quarters. The on-going competitive environment is impacting our business in the form of lower volumes and highly competitive pricing dynamics in the marketplace, and we expect our Q1 results to reflect this, and likely result in an operating loss for the quarter.

The move in hiring J.P. Morgan Securities and RBC Capital Markets is a desperate one at best, as the lack of sales and innovation has moved the Canadian company into extremely difficult times.

The goal of this decision is to find options and methods that leverage the Blackberry platform. Such examples include partnerships, licensing, and other business model options.

Although we are facing challenges, we remain excited about BlackBerry 10 and believe that this platform coupled with the results of the strategic review will create long-term value for our stakeholders. We will provide another more detailed business update when we report our first quarter results in June.”

Today’s news may be the first sign that RIM is ready to be sold, as many have predicted that the best move for RIM is to package itself up for sale. J.P. Morgan Securities and RBC Capital Markets could do just that.

[via Marketwire]