This is How Investors View the Big 3 ‘Oligarchy’ in Canada

Canadian customers still pay some of the highest prices for wireless services, studies say. But you know, you don’t need a study commissioned by the government or a private company to see that: Just have a look at your monthly bill, and you’ll know. The reason: The market lacks competition, as it is controlled by three major players.

However, what’s bad for Canadian wireless consumers is good for investors: Less competition means they (the carriers) can charge higher prices than they would do in a highly competitive market. Just check the prices in the areas where they have a strong competitor.

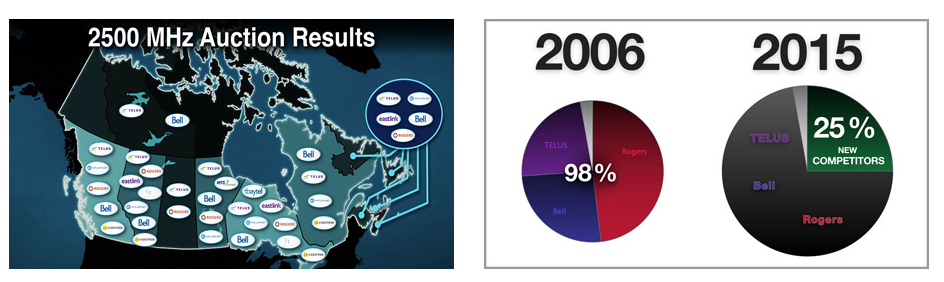

The highly concentrated Canadian wireless landscape has been the topic of discussions on many forums and became especially hot when Verizon was rumoured to be entering the market. The government has taken some steps to change this: We can see from the latest stats released by Industry Canada after the 2500 MHz spectrum auction that 25% of wireless holdings are now in the hands of smaller carriers, as opposed to 2% in 2006. That’s a huge change, but it means almost nothing, because the market is still controlled by the big three, who account for 90% of the Canadian market.

So what does the market look like in the eyes of an investor? It certainly looks good, especially in terms of Bell, which has the most diversified business of the Big Three, according to Sure Dividend. You know, investors are mostly interested in dividend yield, so here is how it looks:

– TELUS has a 4.0% dividend yield

– Rogers Communications has a 4.5% dividend yield

– BCE has a 5.2% dividend yield

In addition to having the highest yield, BCE is also the most diversified and largest of these 3 businesses. The market cap of each is listed below:

– Rogers Communications has a market cap of $18.1 billion

– TELUS has a market cap of $20.7 billion

– BCE has a market cap of $34.6 billion.

Actually, Bell seems to be the most attractive company for investors, because it provides safety, a stable balance sheet, and proved its strength during the recession between 2007 and 2009.

So, in the end, small carriers have a combined 25% of the available spectrum and 10% of the market, but the money goes to the Big Three. We see steady growth among smaller players, but none of them has the financial power to extend coverage nationwide. In other words, the oligarchic market is here to stay as long as you pay your wireless bill.