Rogers ‘suretap’ Mobile Wallet to Launch in Coming Weeks

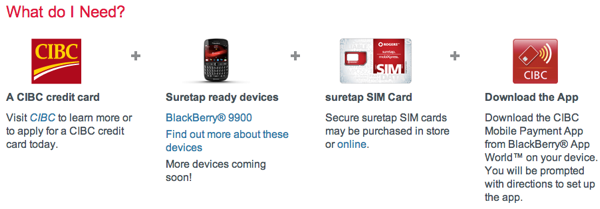

Word of Rogers and their NFC mobile wallet plans called suretap was first known last October, with a partnership with CIBC and MasterCard, powered by a Gemalto SIM-based NFC solution. Today, Rogers has announced its suretap mobile wallet will launch “in the coming weeks”:

“The arrival of our mobile wallet is a major step towards our vision of a mobile experience, where Canadians will quickly and securely access cards they carry in their physical wallet on their smartphone,” said David Robinson, Vice President of Emerging Business at Rogers. “We have built a strong foundation to deliver financial services and mobile commerce solutions, and we will continue to deliver mobile payments experiences that are beneficial for consumers and retailers across Canada.”

Rogers will also launch co-branded prepaid MasterCard available at various retailers for customers to fund their suretap wallet.

The suretap mobile wallet will allow customers to make small purchases up to $50 via compatible Rogers devices, such as a BlackBerry 9900/9790, BlackBerry Curve 9360, BlackBerry Z10 models, Samsung Galaxy S III, Galaxy Note II and LG Optimus G. The iPhone won’t work with suretap.

Anyone interested in the Rogers suretap mobile wallet?