Apple Set to Appeal $14 Billion EU Tax Ruling in Ireland

Apple will this week file its appeal of a European Commission decision that it owes Ireland billions in back taxes, while the latter’s Department of Finance has revealed details of its own appeal, according to a report from Reuters.

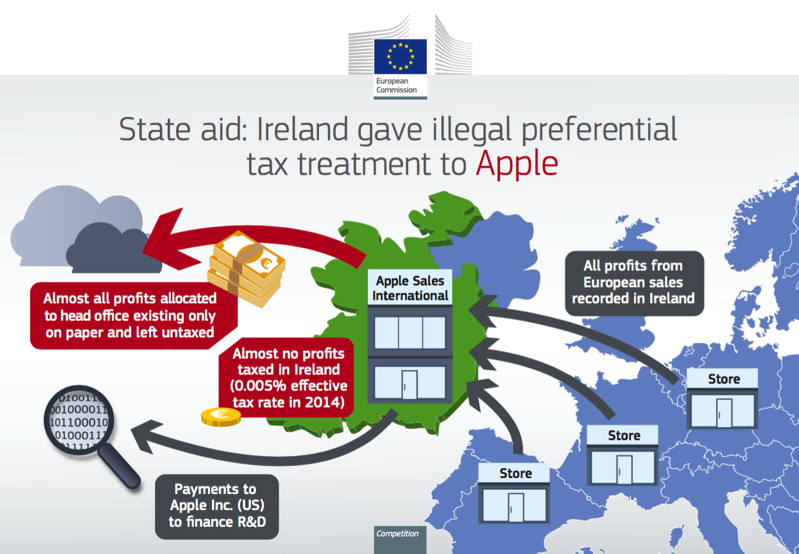

Margrethe Vestager, the European Commissioner for Competition, said on August 30 that Apple must pay up to €13 billion in back taxes, plus interest, because opinions given by the Irish tax authorities in 1991 and 2007 constituted illegal state aid. Her decision concluded a two-year investigation of the company’s tax affairs stretching back to 2003.

Apple CEO Tim Cook previously dismissed Vestager’s ruling as “total political crap” and announced the company’s intention to appeal.

Now, over three months later, Apple is ready to file an appeal with the General Court, the European Union‘s second highest court, the company’s General Counsel Bruce Sewell and Chief Financial Officer Luca Maestri told Reuters in an interview.

In a statement, Apple said it was confident the ruling would be reversed:

It’s been clear since the start of this case there was a pre-determined outcome. The Commission took unilateral action and retroactively changed the rules, disregarding decades of Irish tax law, US tax law, as well as global consensus on tax policy, that everyone has relied on. If their opinion is allowed to stand, Apple would pay 40% of all the corporate income tax collected in Ireland, which is unprecedented and, far from leveling the playing field, selectively targets Apple. This has no basis in fact or law and we’re confident the ruling will be overturned.

The Irish government decided to appeal the ruling alongside Apple, and on Monday the country’s Department of Finance published an outline of its arguments, saying the Commission misunderstood the relevant facts and Irish law.