Mobile Wallets Like Apple Pay Driving Contactless Payments in Canada

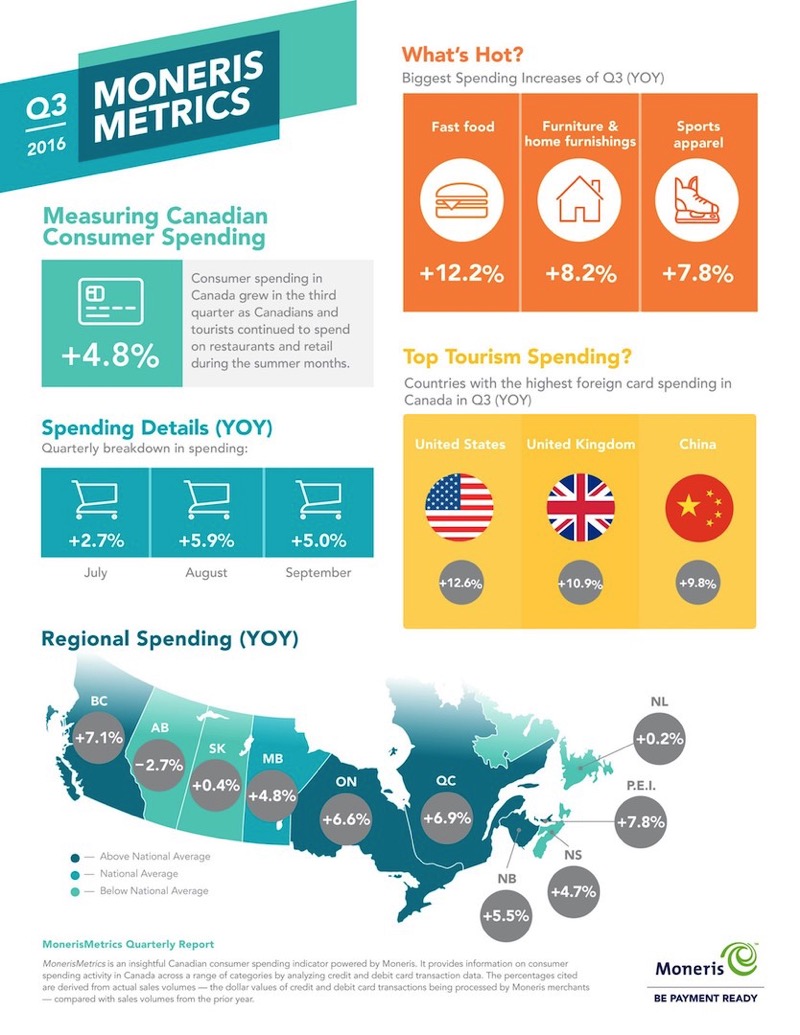

Moneris says consumer spending in Canada jumped nearly 5 per cent in the third quarter of 2016, according to the same period a year ago, as noted in their quarterly MonerisMetrics report.

The report says spending on credit cards took 65 per cent of transactions, versus 35 percent on debit cards. All provinces showed spending increases, except Alberta, which saw a nearly 3 per cent decline, year-over-year.

When we take these into the consideration of contactless payments via cards and smartphones with mobile wallets, contactless purchases represented nearly 33 per cent of all transactions in Q3, a massive 85 per cent jump year-over-year. Contactless spending volume surged 145 per cent compared to the same quarter last year.

Angela Brown, President and CEO of Moneris, said in a statement “High growth in the number of contactless transactions being made and volume of dollars spent is indicative of where we are headed with the technology, as more Canadians adopt mobile wallet options such as Apple Pay.”

Canada’s big banks launched Apple Pay support in May and June of this year, which most likely helped drive up those contactless payment numbers for both credit and debit cards. As more and more banks adopt Apple Pay, these numbers will continue to keep climbing.

Have you been using Apple Pay for your daily transactions?