Technology Like Apple Pay Could Lead to Spending Problems: Credit Counsellors

Apple Pay expanded to Visa and MasterCard last week, with support coming from RBC and CIBC (Scotiabank, TD and BMO to follow in June). The mobile wallet makes it more convenient to use your credit card while on the go—but could it result in increased spending?

According to Jeff Schwartz, executive director of Consolidated Credit Counseling Services of Canada, he explains to The Canadian Press the ease of quick payment solutions, including contactless payments such as Apple Pay, can possibly make it harder for people to control their spending.

“It is allowing many consumers to avoid the harsh reality of what is going on inside their bank account or even inside their wallet,” explained Schwartz, adding it’s much different whipping out your wallet versus paying with your smartphone.

“You really have to say that I am willing, ready and able and want to make this purchase,” he said, adding “There is a real mental link between you actually going in and making that purchase versus just whipping open your phone, throwing it on the scanner and you’re done.”

Credit counsellor Pamela George, from the Credit Counselling Society in Ottawa, argues otherwise, saying mobile payments are making purchases easier. The real problems, she emphasizes, is when users buy items on a credit card, spending money they don’t have, saying “The problems happen where people are just putting it on a credit card and they don’t have a clue where or how they’re paying it.”

George says people may get blinded by just tapping their cards to pay, saying “The problem starts when you don’t track your spending and then you just keep swiping the card,” adding “It is harder to break a $20 bill for a $3 cup of coffee than it is to just tap a card.”

Schwartz says their agency offers a free iOS app to help users record spending on export offline into a spreadsheet, noting “That is the upside to the technology. But the basis behind it is budgeting and understanding what money you have coming in, understanding what money you have going out and understanding what money you have potentially available.”

The free budget tool is available here, but was last updated six years ago. A better iOS app to track your spending and budgeting is either Mint or Wally (they told us in late April version 2 is coming in the next few weeks).

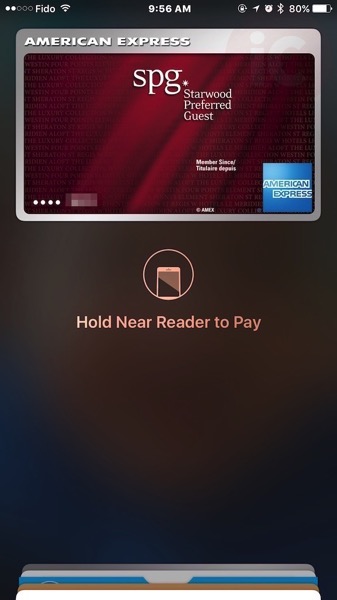

What do you think? Contactless payments with credit card require taking your wallet out and reaching for your card. But now with Apple Pay, the card is no longer physical, but just represented by an image on your iPhone (can we also note how beautiful these images are?).

Do you think Apple Pay will make your spend uncontrollably versus cash or swiping a credit card? The bottom line is if you don’t have self control, whether you’re paying cash, credit card or with Apple Pay, you will still spend yourself into a hole.

Click here to learn tips on how to check out faster with Apple Pay.