Apple Pay to Accelerate the Adoption of NFC-Based Technologies: Analyst

Apple Pay will boost the adoption of NFC-based payments and will become the industry standard, investment firm analyst Craig Hettenbach wrote in a “blue paper” to investors — obtained by AppleInsider.

The mobile payment service Apple announced on September 9th will have no trouble gaining traction, Hettenbach says, as it is compatible with the existing infrastructure. Like Apple said, it will already be deployed in more than 220,000 locations (and counting) at launch.

Apple seems to have solved two problems with Apple Pay: The service is sufficiently cost effective and attractive for merchants, and it is sufficiently intuitive and convenient for consumers, the analyst says. Actually, this will be under the stress test when it launches.

Since Apple’s mobile payment platform uses an infrastructure already in place, the analyst is confident that it will be highly successful. It will also increase the adoption of NFC-based technologies: According to Hettenbach, this could mean that up to half of the payment terminals will have NFC capabilities by this time next year.

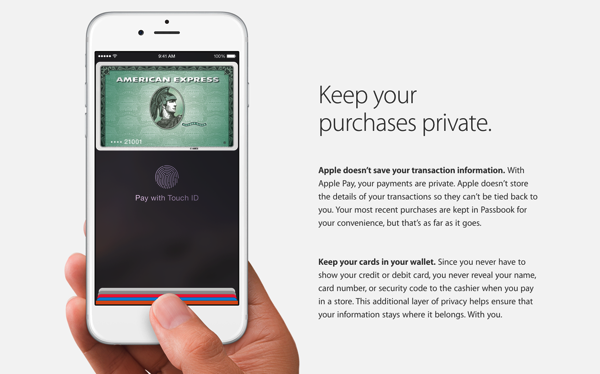

Apple Pay will launch this month with participating banks such as American Express, Bank of America, Capital One, Chase, Citi Bank, and Wells Fargo, with others such as Barclaycard, Navy Federal, PNC, USAA, and US Bank coming soon.

Apple Pay will be limited to the US upon launch in October, but the US isn’t the only country with the necessary infrastructure in place: Canadian infrastructure is ready as well. We already have NFC terminals, and carriers have already deployed NFC payments. However, as Jeff Martin, vice president and CIO of Direct Channels Technology Solutions at TD Group pointed out, we will have to wait until Apple Pay arrives in Canada.