Apple Pay VP Explains Why Launch in Canada Was Delayed

The day Canadians have been waiting for has finally arrived: Apple Pay has expanded to Visa and MasterCard with Canadian bank support, no longer limited to American Express cardholders.

In a lengthy interview with The Financial Post, Apple vice-president of Apple Pay, Jennifer Bailey, explained more about the mobile wallet and also detailed why there was a delay in expanding support here in Canada to our big banks.

Bailey explained Interac integration was one of the major reasons for the delay here, saying “Adding a new network to Apple Pay’s platform takes new work for both Apple and the network itself,” noting “All of the partners — the banks, Apple and the networks — have to build up this new integration and do full testing.”

Back in February, Interac announced the launch of their own Token Service Provider (TSP) for their debit network, which many suspected was preparation for Apple Pay. We now know that was indeed part of the Apple Pay roadmap. Tokenization allows one-time unique encrypted tokens to replace your debit/credit card number when using Apple Pay, adding extra security to the mobile wallet.

Avinash Chidambaram, Interac’s vice president of product and platform development, said TSP was something they’ve been working on for a long time now, saying “We have been working on it for a year and half,” adding “But we have also been working with Apple to educate them on the Canadian market [and] highlight our ubiquity.”

On top of the Interac integration issue, banks also worried about client security and being able to preserve existing client relationships, while also wanting to not have customers choose between Apple and their bank, given the tech giant’s massive brand power, notes the Post.

Also, interchange fees, which provides Apple a small cut from each customer transaction, appears to have been settled. Banks did not comment on financial terms of Apple Pay on Monday, notes the Post.

Bailey went on to say “We designed Apple Pay from the beginning so that the information about your transaction really is between you, your merchant and your issuer,” detailing how “When you pay in store, Apple doesn’t actually see that transaction because the credential is being initiated from your phone to the terminal, up through the network and then once approved it goes back through the payment rails.”

The vice president of Apple Pay also echoed keeping data private was the company’s priority, adding Apple is not building profiles on customers, and is not doing any form of targeted advertising either, when they use the mobile wallet.

Apple customers “have spent billions of dollars in Apple Pay”, says Bailey, noting one million new users are being added each week.

Bailey also credited the excitement Canadians expressed on social media as a sign of how badly we wanted Apple Pay, saying “If you go back and look at social media, it is a great indicator of the excitement and people’s reaction to Apple Pay,” adding “They (reach out) to partner banks saying, ‘Hey we really want you to support Apple Pay.’”

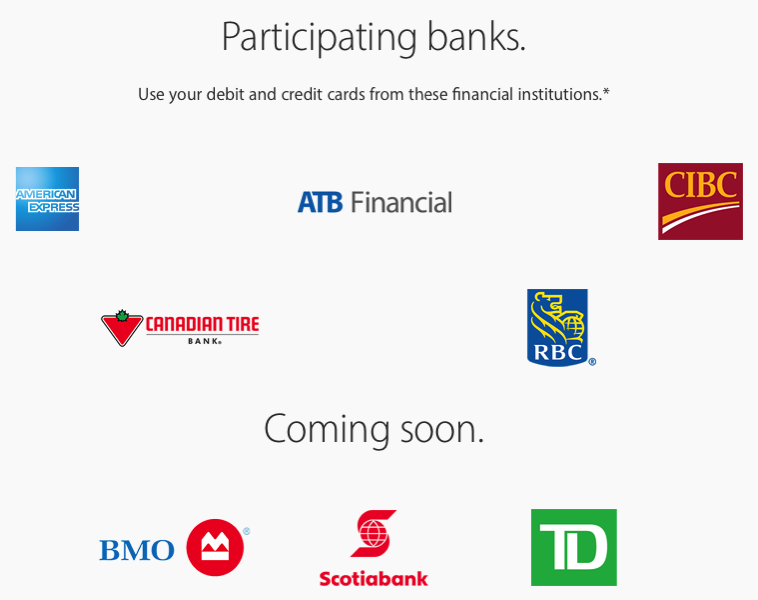

Apple said they are “thrilled” seven of Canada’s leading banks plus the Big Five are supporting Apple Pay.

This morning, RBC and CIBC were the first to support Apple Pay, allowing customers with debit, Visa and MasterCards to use the mobile wallet. TD, Scotiabank and BMO have announced Apple Pay is “coming soon”, with a launch pegged for next month. Scotiabank told us specifically “mid-June”, while BMO said “in the coming weeks”.