Apple’s Share Price Keeps Climbing, Analysts Expect More Gains

Apple stock has been on an incredible bull run over the past few weeks ever since it announced its record-high quarterly earnings. Now many analysts are expecting the share price to continue climbing for quite some time.

Apple share price rallied to another record close Tuesday, after an upbeat research report from Morgan Stanley, which cited optimism over the outlook for China sales as well as the imminent announcement of the highly-anticipated iPhone 8.

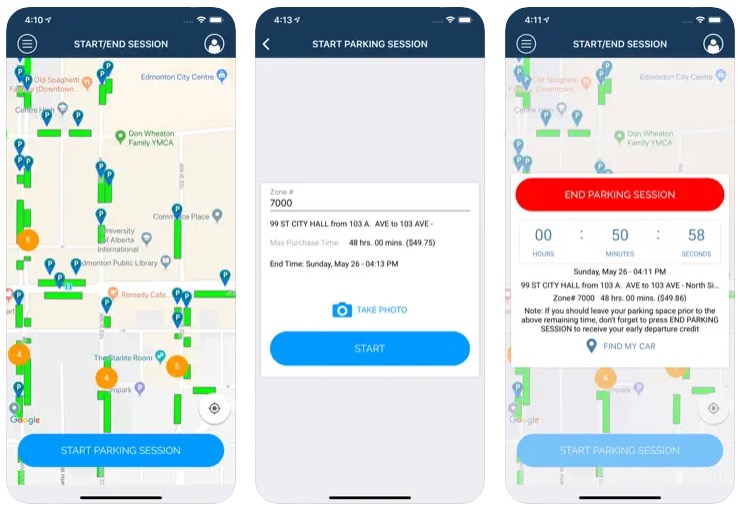

Apple’s upcoming iPhone 8 is looking as if it could represent a total overhaul to the current iPhone design. Recent rumours suggest that the upcoming flagship version of the iPhone could have an edge-to-edge OLED 5.8-inch display, integration of Touch ID (or even facial recognition) into the display, the elimination the home button, 3D facial-recognition capabilities, wireless charging, and a cost upwards of $1,000.

A major overhaul like this could easily solicit a monster upgrade cycle, akin to huge growth in iPhone sales sparked by the iPhone 6 and 6 Plus launch several years ago.

Apple’s 2016 flagship iPhone launch broke from the company’s usual practice of redesigning the smartphone’s form factor every other year. The iPhone 7 and 7 Plus supported the same general design as 2015’s iPhone 6s and 6s Plus and even 2014’s iPhone 6 and 6 Plus. Nevertheless, iPhone sales hit a record high in the company’s most recent quarter. In Apple’s first fiscal quarter of 2017, iPhone revenue and units were up 5% year over year.

This bodes well for the strength of Apple’s iPhone business. If Apple can continue growing iPhone units and revenue in its important holiday quarter with a three-year-old form factor, Apple’s iPhone business may be better off than investors realize. Customers appear as willing as ever to buy an iPhone. Apple’s absolute number of iPhone upgraders and the number of buyers switching from another smartphone were both at an all-time high in the company’s most recent quarter, CEO Tim Cook said in Apple’s first-quarter earnings call.

Since Apple reported its Q1 earnings on Jan. 31, at least nine analysts have raised their stock price targets, and “the thing about stock analyst projections is that they have a way of becoming self-fulfilling prophecies in the short-term,” reads a report from VentureBeat. “Analyst raises target. Investors get excited and bid up stock. That’s generally okay for Apple.”

So, all in all, it looks like things are looking quite good for the Cupertino company. Looking to buy some Apple stock? Might be the time to do so, before it’s too late.