BMO, Mastercard Launch Biometric Corporate Card Program in Canada

Bank of Montreal (BMO), Canada’s fourth largest lender, said on Wednesday that it had launched the first biometric corporate card program in Canada and the United States in partnership with Mastercard.

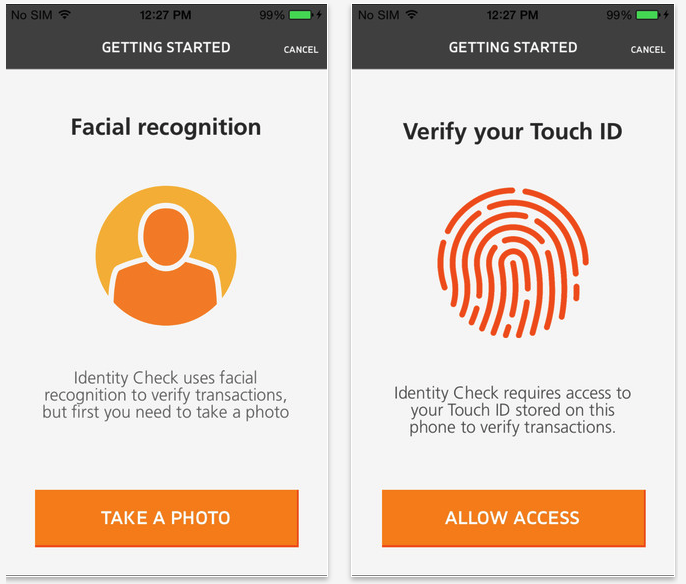

Last month, MasterCard announced ‘Selfie ID’ which would let users verify their online payments using facial recognition. The ‘Selfie ID’ program is set to expand to Canada this summer. The new program will expand the outreach of this program to corporate customers.

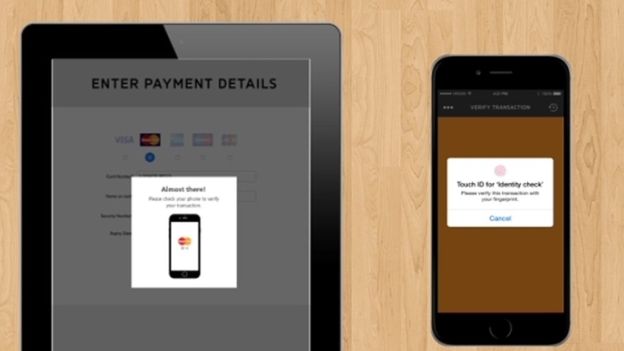

BMO and Mastercard said the technology will enable corporate cardholders to verify transactions using facial recognition and fingerprint biometrics when making online purchases.

In a statement, they said the introduction of the technology will increase security when making payments that don’t include a face-to-face interaction. The program will begin with the issue of corporate cards incorporating the technology to BMO employees in Canada and the United States.

Banks’ security procedures are coming under scrutiny amid evidence of increased attacks from sophisticated hackers. Steve Pedersen, vice president of North American corporate card products at BMO, said:

“The use of biometric technology has become more common for consumers looking for convenient and secure ways to make purchases using their smartphones, so this was the natural next step for us as innovators in the payment security space. Mitigating the risk of fraud is always our top priority, and the inclusion of this technology is going to make payment authentication easier, and strengthen the security of the entire payments ecosystem.”

In a statement, Catherine Murchie, Senior Vice President of North America Processing, Enterprise Security & Network Solutions for MasterCard, said:

“With BMO, MasterCard is hosting our first Canadian and U.S. corporate card biometric user engagement. It’s always exciting to introduce biometrics to new cardholders. They quickly realize that they don’t have to sacrifice convenience for security. By snapping a selfie or scanning a fingerprint, the person becomes the password.”

The MasterCard Identity Check mobile app will prompt participants to scan fingerprints or snap selfies to validate their identities via biometrics. When the payment is verified, the customer would return to the merchant site to complete the online purchase.