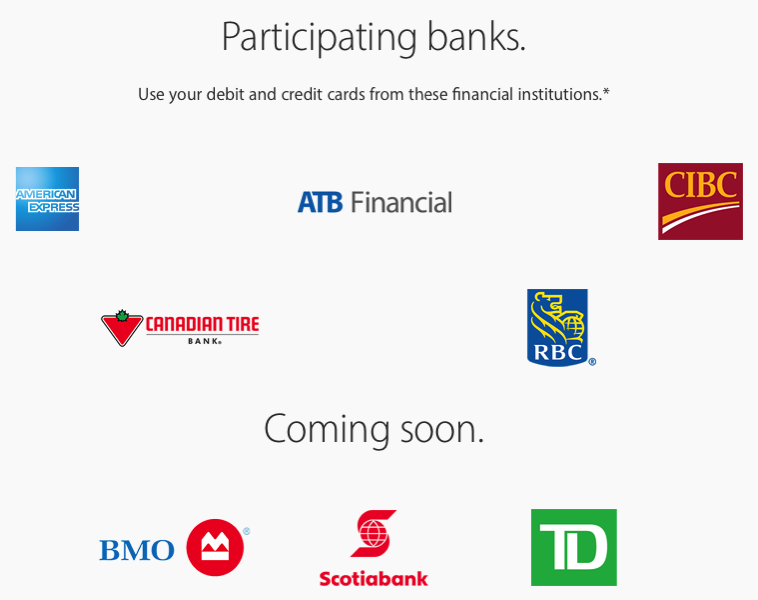

CIBC Apple Pay Adoption “Quite Strong”; BMO, TD, Scotia Launch in “Several Weeks”

How popular has Apple Pay been since its expansion to CIBC and RBC just over two weeks ago? So far, so good, according to CIBC.

David Williamson, head of retail and business banking at the financial institution, told The Globe and Mail (paywall), adoption rate of Apple Pay amongst their consumers has been “quite strong”, while usage amongst those who have downloaded the CIBC app has been “very strong”.

The decision to support Apple Pay has had Canadian banks defending the decision to investors and analysts, as some fear Apple could interfere with customer interaction and also erode profits through interchange fees involved with the mobile wallet, reportedly at 15 cents for every $100 transaction.

When one analyst asked Williamson during a recent conference call why CIBC would let Apple get in the way of their customers, the executive reasoned banks needed to “evolve and adapt” to be successful, versus putting up barriers.

Williamson said potential fees paid to Apple could be made up through more transactions and volume, saying “[Apple Pay] is something that’s big as far as a development in how you pay,” adding “It’s big as far as the changing way that payments will be done over time. It’s not really big as far as an economic driver in our results.”

BMO’s head of personal and commercial banking similarly noted interchange fees would not impact revenue, while also expressing customer demand was a driving factor to implement Apple Pay, saying customers are “the ones who get to choose the way in which they want to make payments, and we as participants in the market don’t always get to choose who will be in and who will be out.”

Meanwhile, RBC CEO Dave McKay did not seem worried about Apple getting in the way of the bank, as the bank’s brand, product offerings, and trust and long-term relationships are “key drivers” against competitors and non-traditional rivals.

The Globe and Mail noted TD, BMO and Scotiabank will launch Apple Pay in “several weeks”. These remaining three big banks have already updated their iOS apps to note support for Apple Pay is coming soon.

The delay of Apple Pay in Canada, as noted by Apple, was due to barriers in integrating Interac to the mobile wallet platform.

Apple Pay will be coming soon for all, so stay tuned!