CIBC Announces Free Equifax Credit Scores within Mobile Banking App

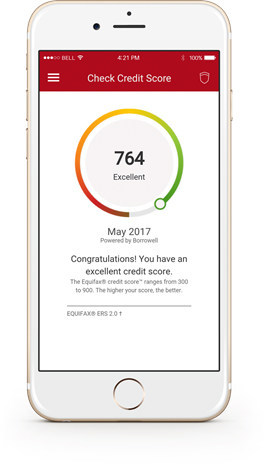

CIBC has announced it has partnered with fintech Borrowell and Equifax Canada to offer free credit scores for customers, in what they are calling a first for a major Canadian bank. The free credit score check will be available within the CIBC Mobile Banking app first, and will be available online later this year for all clients.

The Equifax credit score can be accessed anytime and will be updated quarterly. These are “soft” credit checks so they do not affect your overall credit score, versus “hard” checks.

CIBC research says nearly 50 per cent of Canadians don’t know their credit scores, but staying on top of scores is one way to be vigilant against fraud, while also important to know ahead of making major financial decisions such as getting a loan or mortgage.

“As we continue building a personalized digital banking experience for clients, we are also delivering technology that can help clients make informed financial decisions when, where and how they want,” says Aayaz Pira, Senior Vice President, CIBC Digital, Retail and Business Banking, in a statement to iPhone in Canada. “With a simple tap on their mobile banking app, clients can easily access their credit score, allowing them to have a full-picture of their overall credit health, and better control of their finances.”

Pira added, “Increasingly, clients also want a mobile banking experience that offers deeper insights into their overall finances keeping them connected to the big picture, and new services like free credit score make that a reality.”

We earlier reported CIBC Mobile Banking iOS app was updated on Monday, which stated Equifax credit scores had launched. But the update was soon pulled, which led to some confusion. The current iOS description now states Equifax is there, so let us know if you see the credit score button in the sidebar. CIBC has confirmed it is now live.

Click here to download CIBC Mobile Banking for iOS in the App Store.