Costco Says Capital One MasterCard Won’t Support Apple Pay

You’re probably tired of your friends who bank at RBC and CIBC talk about Apple Pay (and those AMEX early adopters) by now, right?

While we know TD, Scotiabank and BMO are set to launch support next month for Apple Pay, what about other credit cards, such as the Capital One MasterCard from Costco?

On May 10, Capital One told customers on Twitter they had “nothing to announce” regarding Apple Pay. One week later, they clarified “There are no immediate plans for Apple Pay but we’ll be evaluating it & other payment tools.”

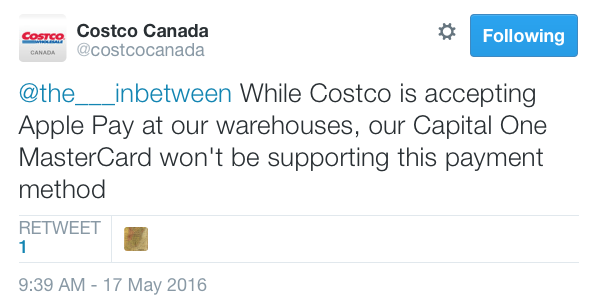

Now Costco Canada is being more explicit about Apple Pay support from their warehouse MasterCard. They’ve been telling customers on Twitter the Capital One MasterCard “won’t be supporting this payment method.”

The contactless terminals at Costco, according to iPhone in Canada readers, can accept tap up to $200, with something being able to tap for slightly higher amounts.

While it can be disappointing to learn the sole MasterCard you may own won’t support Apple Pay, it’s probably a better idea to go with a card from a big bank that will, so you don’t wait forever. At least terminals at Costco accept tap for MasterCard, so that means you can still pay with a different MasterCard (or your debit card).

Thanks @theadub