iOS and Android Users Unite To Fight Rite Aid/CVS Over NFC Mobile Payments Ban

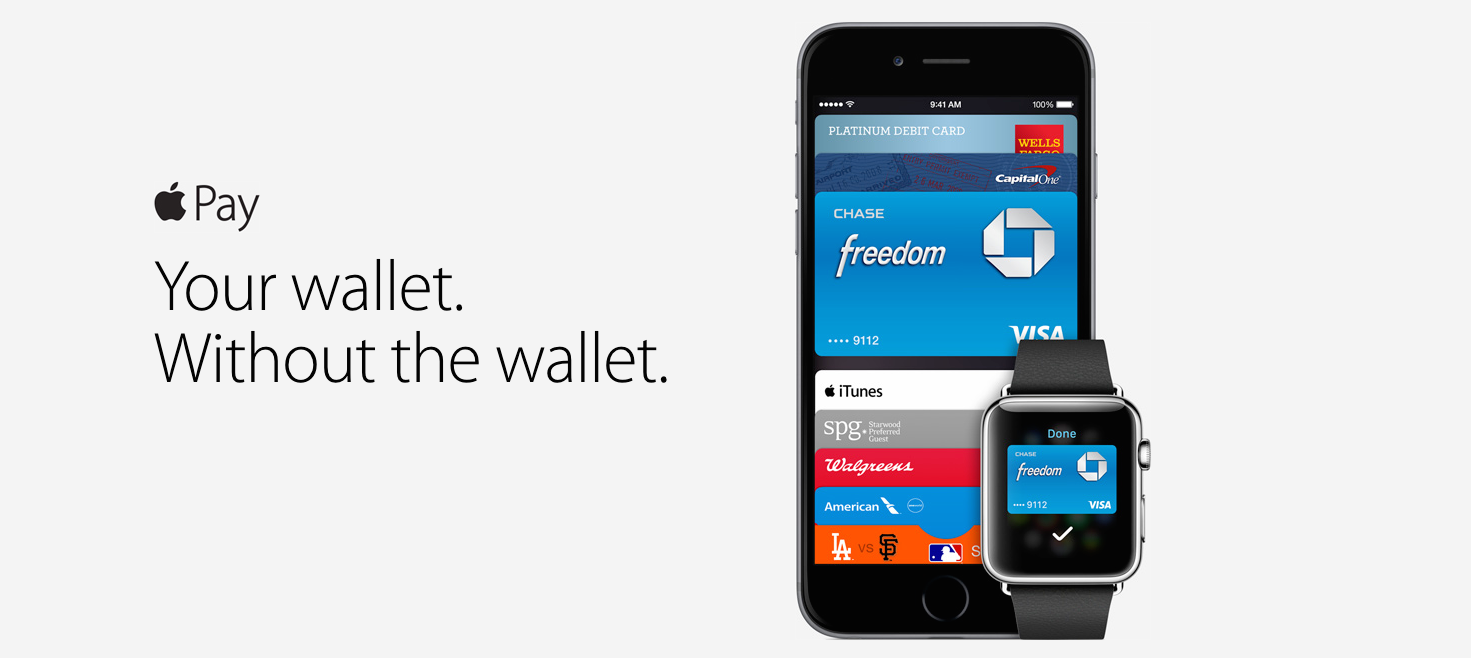

Last week, it was reported that U.S. based drugstore Rite Aid started to disable support for payments using NFC or Apple Pay. Over the weekend, CVS also announced that they would be following in Rite Aid’s footsteps and started preventing customers from using these mobile payment solutions.

Both CVS and Rite Aid are a part of the MCX (Merchant Customer eXchange) consortium, which promotes a rival mobile payment service called CurrentC. CurrentC uses a QR code-based system that is far more cumbersome than solutions like Apple Pay and Google Wallet.

Several Apple Pay users have threatened to boycott retail stores that don’t accept Apple Pay. Various Reddit threads have been created to discuss the topic. Although iOS users are upset about this situation, a number of Android users are joining in the conversation.

Many Android phones also have the ability to make payments over NFC using Google Wallet. The decision from CVS and Rite Aid to block NFC payments also affects Android users’ ability to use their mobile payments solution.

In a statement MasterCard’s chief emerging payments officer Ed McLaughlin said that both companies made the wrong decision and he hopes that they will reconsider.

In a statement MasterCard’s chief emerging payments officer Ed McLaughlin said that both companies made the wrong decision and he hopes that they will reconsider.

“We think consumers should have the ability to pay any way they want. Rite Aid and CVS have been accepting contactless payments for quite a long time. We look forward to them turning the functionality back on in their stores.

Apple Pay is the most convenient, most secure, and what’s best for consumers”

Apple has also issued a comment on the above issue, saying that the feedback they are receiving for Apple Pay is overwhelmingly positive and they are working to get even more retailers on board.

What do you think about CVS and Rite Aid’s decision to prevent customers from paying using an NFC-based mobile payments system? Let us know in the comments below.

[via 9to5Mac]