[u] Bank of Canada: Only 7% of Canadians Use Mobile Payments [Report]

PayPal-commissioned studies have already suggested that Canadians are ready to ditch their wallets in favour of mobile payments. But how does this look in reality? Well, the use of cash is on the decline, but the picture isn’t as bright as studies might have suggested, as Canadians still prefer other payment methods to using their smartphones to pay for goods and services, a discussion paper entitled “2013 Methods-of-Payment Survey Results” released recently by Bank of Canada reveals (via the Winnipeg Free Press).

There is shift away from cash toward electronic payments, the study says, highlighting the rising number of credit card payments versus debit card and cash payments.

The drop in cash transactions is noteworthy compared to Bank of Canada’s corresponding report from 2009: In 2013, cash accounted for 44% of the volume and 23% of the value of total payments, down 10% since six years ago. Credit card transactions are up 11% in volume.

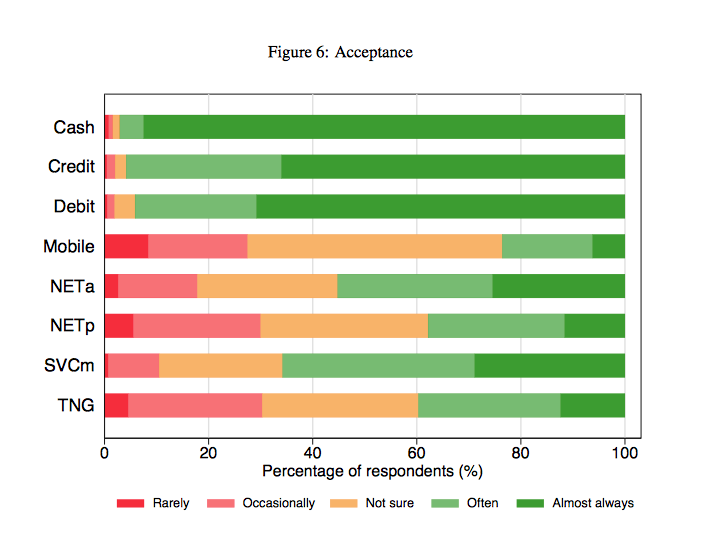

“The decrease in the volume share of cash use is not surprising in light of the introduction of payment innovations such as contactless payment cards and some stored-value cards which were designed to mimic the desirable properties of cash – i.e. they are easy to use and are fast,” the report says.

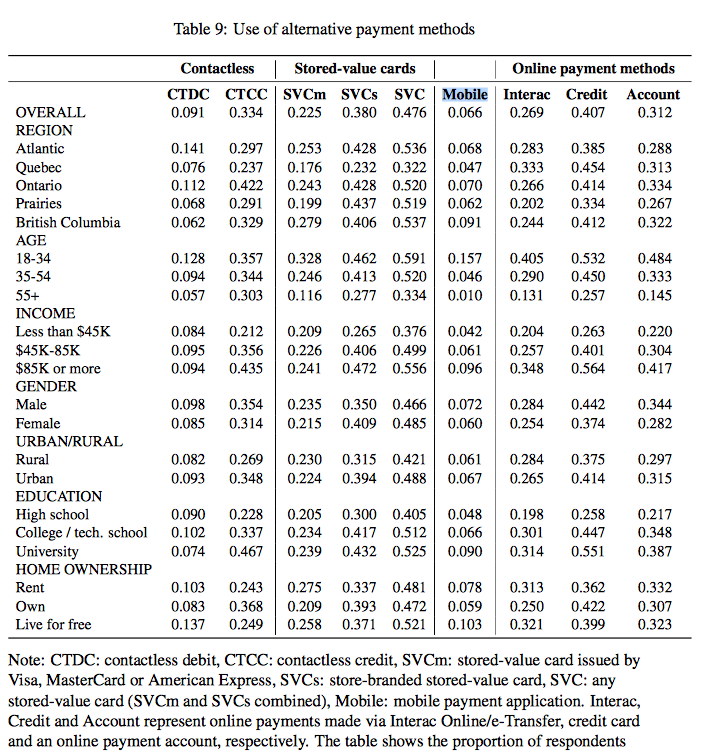

An interesting highlight of the study relates to mobile payments, especially in the light of Apple Pay, which is about to enter Canada in November, according to the WSJ. Fact is, players who have already entered the market have already suggested that adoption rate is slow, but now we have some figures, thanks to the Bank of Canada study: Only 7% of Canadians made a payment using a mobile phone, with the highest usage being among 18–34 year olds.

The report concludes that “advances in technology and new business models may result in more payment innovations that could further affect the use of cash in Canada.” Fact is, to use Apple Pay or any other mobile payment platform, merchants need to accept that payment method, and they need an incentive to upgrade their POS system to accept mobile payments. As for users, they may need to have the latest hardware to be able to pay with a mobile system.

Until then, cash and card payments will continue to account for the biggest chunk of transactions in the country.

Update: Here are some charts you may find interesting.