Suretap Exec Explains Why iPhone Lacks Support for Their Digital Wallet

Suretap is the digital wallet created Canada’s ‘Big 3’ carriers Rogers, TELUS and Bell. Currently, the mobile payment solution is limited to select Android and BlackBerry smartphones and lacks iPhone support.

As for why it’s not available on the iPhone, Suretap president Jeppe Dorff explained to The Star it’s because Apple did not want to negotiate:

Suretap is so far restricted to Android and BlackBerry because Apple refused to negotiate, Dorff said. Apple declined to comment on whether it is deliberately keeping other digital wallets out of its app store or whether Apple Pay will arrive in Canada this fall.

Back in June, when Bell and TELUS announced they would join Rogers in backing Suretap, Dorff proclaimed their mobile payment solution would rise to the top against competitors, saying “we are certainly going to beat Apple.”

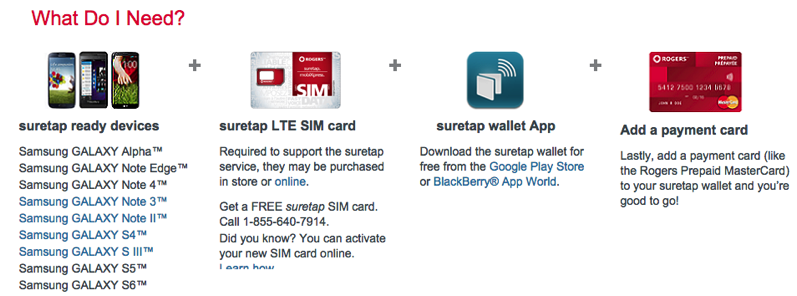

To use Suretap, consumers must own a specific supported handset, obtain an NFC SIM card, download the Suretap wallet app, and have a supported payment card from a participating financial institution.

With Apple having its eyes set for Apple Pay in Canada, it’s obvious why they would not want to participate in Suretap. But more importantly, Apple values customer privacy over anything. Suretap transactions most likely provide the Big 3 and supported banks with your valuable shopping data.

Apple Pay on the other hand, keeps all of this info private and anonymous from merchants and the iPhone maker themselves. Here’s how the company explains Apple Pay privacy when used in stores:

Apple Pay was designed so that when you pay in stores, Apple doesn’t collect any transaction information that can be tied back to you. If you have Location Services turned on, the location of your device and the approximate date and time of the transaction may be sent anonymously to Apple. Apple uses this information to help Apple Pay improve the accuracy of business names in your transaction history and may be retained in the aggregate to improve Apple Pay and other Apple products and services.

When you use rewards passes with Apple Pay, Apple doesn’t receive any information about the rewards transaction other than what’s displayed on the pass.

This spring, the Wall Street Journal reported Apple Pay would launch in Canada sometime in November, something our own sources claimed would also be the case. Then, last week TD Canada Trust let the cat out of the bag, as their website prematurely listed an Apple Pay landing page (we’re hearing BMO plans to support Apple Pay as well).