WSJ Details Apple’s Delayed ‘iWallet’ and How Passbook Emerged Instead

We’ve long heard about the usage of near field communication (NFC) for mobile payments in the latest smartphones, such as the recent partnership between Rogers and CIBC. Google has Google Wallet for Android but what about iOS and the iPhone?

The Wall Street Journal has profiled some details about Apple’s low ambitions toward a mobile iPhone payment, with one project known as “the Superman III” play, a reference to the greedy tech villain from the movie. The latter was a plan to collaborate with an existing payment system and take a percentage of transactions.

According to the WSJ:

Last year, Apple engineers and executives considered some aggressive approaches to exploit that advantage when in-house debate over the market began in earnest. Google unveiled its Android payment system around the same time.

A small group began investigating whether the company should create a new service that would embed various payment methods into the iPhone or build a payment network of its own, according to people familiar with the matter.

Apple’s head of iPhone software, Scott Forstall, was interested in the idea, say people familiar with the matter, and engineers on his team began to brainstorm a comprehensive “wallet app.”

One of the ideas was whether Apple should handle payments to merchants themselves, but the idea was too complex as it would possibly require the company to become a bank, according to a source. From here the team ditched those plans and instead Apple engineers debated the creation of an app that would enable payments, coupons and also provide feedback to users on which one should be used depending on transactions.

The iPhone hardware division had also been researching over the air payment systems, such as one low power Bluetooth system and NFC, noted sources, but executives questioned the idea. NFC was being adopted too slowly by retailers and currently won’t be mainstream for years to come.

One person familiar with the matter noted when the payments plan were under scrutiny by executives earlier this year, the ideas were rejected by specific members of the team:

When the payments plan came to an executive review in early 2012, several Apple senior executives balked, says a person briefed on the meeting.

Apple’s chief financial officer, Peter Oppenheimer, questioned whether there was newer secure technology that employed the Internet rather than use NFC, this person said.

Apple’s Mr. Schiller was worried that if Apple facilitated credit-card payments directly consumers might blame Apple for a bad experience with a merchant.

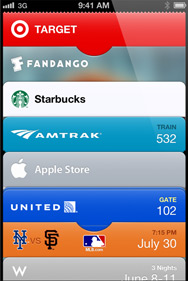

It was here the executive team decided upon a smaller scale version of a payment system and the creation of Passbook (which engineers still refer to as the ‘wallet app), which was revealed at WWDC 2012 as one of the upcoming features of iOS 6, set to be released this Fall.

We noted earlier Apple’s trademark application for Passbook in Canada noted hinted at an ‘iWallet’ possibility. NFC sounds like the future of mobile payments but as it stands, it just hasn’t hit the mainstream. More people need to adopt smartphones with NFC capabilities and merchants also need to get equipped with NFC terminals via our banks and credit card companies.

This is such an ‘Apple move’ to lurk and let others go at it first, before perfecting their own idea and debuting it with a bang. Just look at the iPhone–Apple wasn’t first, but it sure did have the biggest impact on the mobile industry.

Thoughts? When do you predict mobile payments to become the norm? Do you agree with Apple’s decision to delay their payment system?

[via MacRumors]