Apple Suppliers Look Towards Other Markets As Smartphone Sales Decline

Smartphone manufacturers will likely end the year selling 1.45 billion phones, a slight uptick in sales from 2015, industry analysts at IDC said in a new report this week. If IDC’s forecast is accurate, that’ll represent year-over-year growth of just 0.6 percent. By comparison, smartphone sales grew 10.4 percent from 2014 to 2015.

As Apple’s smartphone sales decrease, the effects are far reaching, especially for the many companies supplying the hundreds of parts that go into a smartphone, according to a new report from the Financial Times. The vast majority of these companies are located in Asia.

“With sales of 1.5bn a year, smartphones are a monster market,” says Steven Pelayo, tech analyst at HSBC, who points to the relatively smaller PC and tablet markets. “It’s been a supercycle that has cannibalised everything. But what’s the next big driver?”

This question is being asked across boardrooms and factory floors of the myriad of companies that act as Apple’s suppliers.

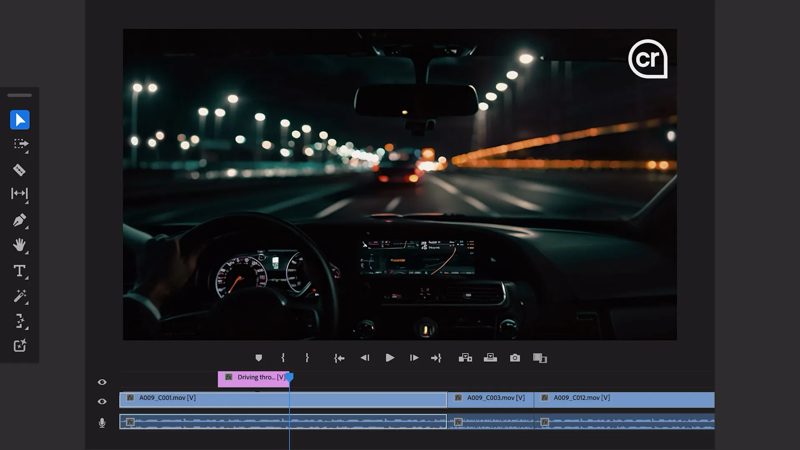

Mitsuru Homma, chief executive of Japan Display, which generates 85 per cent of its revenues from smartphone makers and half from Apple, sees a future for his company in self-driving cars, which will require interactive screens and maybe entire smart dashboards as well as medical monitors. He also sees opportunity in the future of virtual reality.

Some are undeterred by the declining smartphone numbers, pointing out that the devices are still in the picture for now, despite growing slower and with an evolving modus operandi.

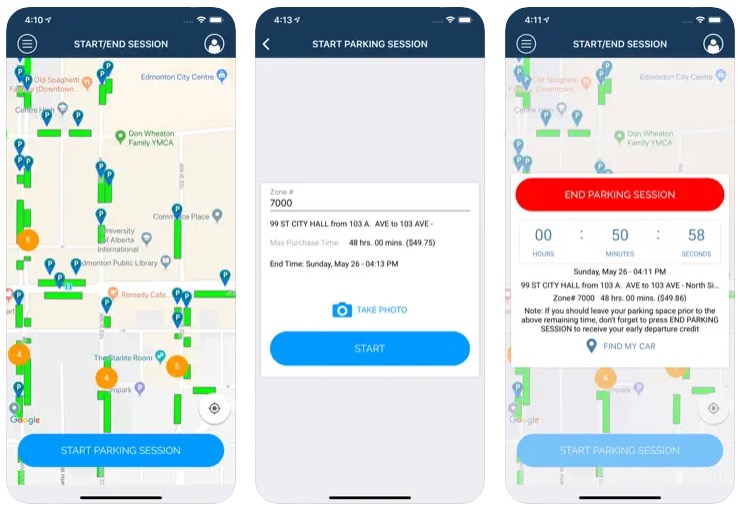

“You’ve got to look at what the smartphone brands are doing,” says Cherry Ma, tech analyst at CLSA. She believes two trends will drive growth in certain areas: smartphone makers upgrading cameras, sound, and aesthetics in an attempt to win market share as well as a consumer swing towards Chinese handset manufacturers.

“Over time, we suspect supply chain growth will be driven by an ever broader array of products,”says Steven Pelayo, tech analyst at HSBC, “but no individual segment will probably catch the smartphone market any time soon.”