Proposed Rules Mean Canadian Retailers Could Block Mobile Payments Such as Apple Pay

According to the Wall Street Journal, Canadian merchants could gain the right to block mobile payments from credit card companies such as Visa and MasterCard, even if plastic versions are accepted.

The changes come as Canadian Finance Minster Joe Oliver is set to announce revised changes to the country’s code of conduct for the credit card and debit industry.

An advanced copy of the draft was seen by the Journal, and the following passage notes how merchants could be able to block credit card mobile payments should fees increase for the latter:

“Should fees set by the payment card networks in respect of contactless payments made from a mobile device increase relative to card-based contactless payments, payment card networks will develop the technical specifications to ensure that merchant acceptance of contactless payments made from a mobile device can be canceled at the point of sale without disabling other forms of contactless payments acceptance,”

Also, proposed changes would free merchants from being obligated to accept mobile wallet and smartphone payments, even if they accept normal credit card payments via traditional plastic cards.

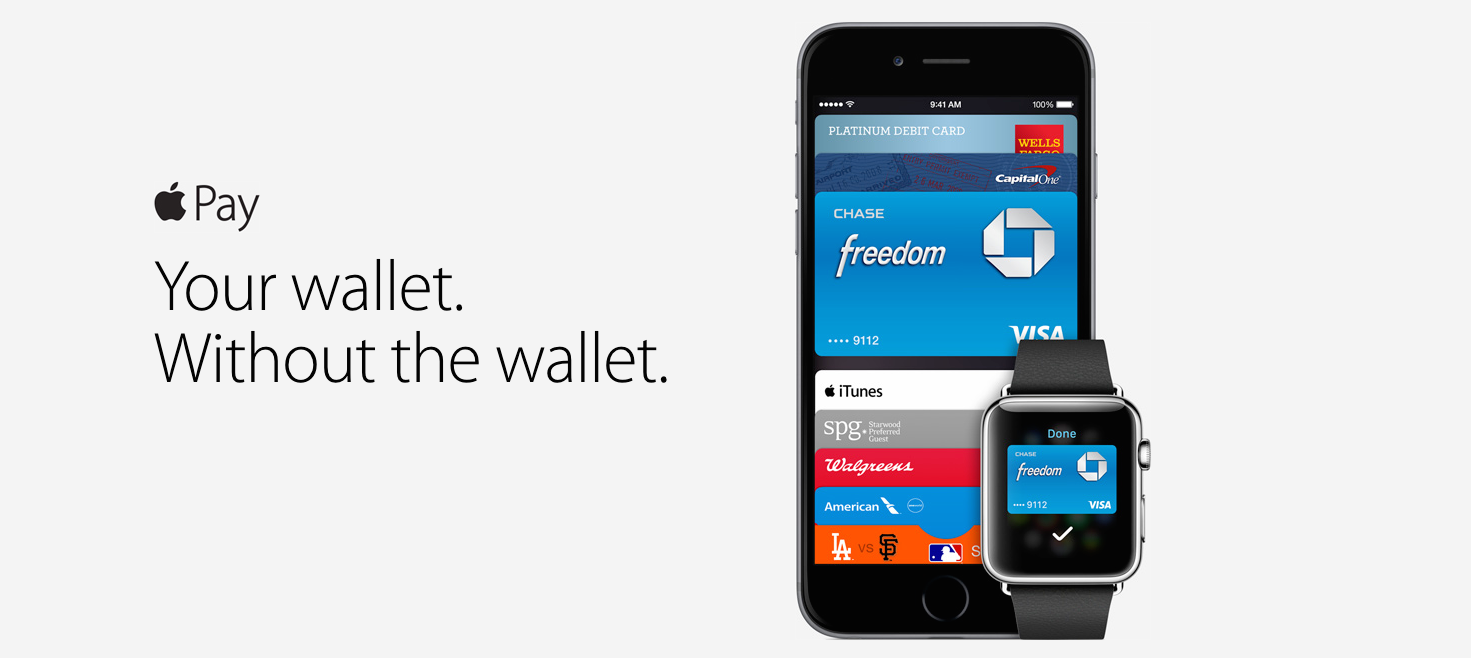

Merchants are wary credit card fees will increase once mobile payments go mainstream, which could be assisted by the future arrival of Apple Pay in Canada; currently, Apple’s mobile wallet is only available in the USA but our large network of NFC terminals mean some Canadians are already testing the service.

We’ve seen merchants in the U.S. form their own opposition to credit card fees, through the MCX consortium, which includes retail giants such as Walmart, Best Buy and Target. These retailers hope to debut their own QR-code based mobile payment system called CurrentC, which would be tied to a customer’s chequing account or be funded by store gift cards, as a way to bypass credit card processing fees.

When American drug store retailers CVS and Rite Aid blocked Apple Pay and Google Wallet by disabling NFC point-of-sale terminals, both companies faced heavy backlash online from customers.

Dan Kelly, head of the lobby group Canadian Federation of Independent Business, told the WSJ “We’ve have been worried that mobile payments leave the potential for another fee grab.”

He followed up to say “To the best of my knowledge, no country has given merchants these new powers: the power to say no to one type of Visa [or MasterCard] transaction and yes to another.”

Could we see a similar CVS/Rite Aid fiasco in Canada over mobile credit card payments? Both Visa and MasterCard already agreed to lower swipe fees paid by Canadian merchants, a move made to bypass the federal government from imposing lower fees.