U.S. Banks Race to Get Their Cards as Default Option in Apple Pay

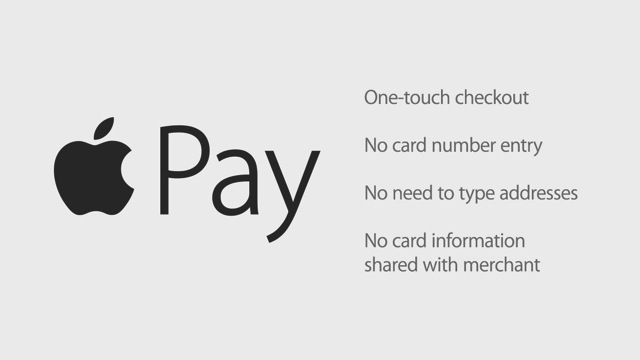

Looks like the U.S. banks are already in a marketing race to persuade their customers to choose their Visa, Master and AMEX cards as the default option under Apple Pay, the Cupertino giant’s new mobile payments system which will debut in the U.S. next month. According to The Financial Times, marketing staff from these banks are due to meet at Apple’s headquarters in Cupertino on Tuesday.

According to people familiar with the matter, the banks do not have a free hand in what they can do, and they will be receiving strict guidelines from Apple at the meeting on how they can advertise Apple Pay to customers. “It’s a healthy competition,” said Kristin Lemkau, chief marketing officer at JPMorgan Chase, adding that their bank wants to be the first to launch Apple Pay on their mobile app, website, in their 5,600 branches, on their ATMs, and on their Times Square sign. She added, “You want to create an incentive for people to download their card in Apple Pay and use it as their default card.”

Jud Linville, head of cards at Citi, said the competition was going to be about designing an “elegantly simple and secure” customer experience.“There will be some who are really good at it and some who are slower to build those things and market them effectively,” he said. “I’m leading my team as if ‘this is first to the prize’.”

“The details around paid communications within Passbook [the app that currently stores customer information] are going to be critical to competition,” said Matt Krogstad, head of mobile at Bank of the West, the San Francisco-based lender. “If I can pay to put an advert within Passbook – eg tap here to make this the default card – then Apple has created a scenario where whoever the highest bidder is will be able to communicate with customers. That will be a negative.”

While Banks do not yet know full details of Apple Pay’s functionality, most believe that customers will get to choose a default card from a small selection of heavily-promoted big bank issuers, which may risk smaller banks losing market share.