Apple Is Repurchasing Its Own Shares As Fast As Possible

Fortune is reporting that Apple is currently buying its own shares as fast as it can. Scheduled to repurchase 10 million shares in Q3, the Cupertino company ended up buying 36 million during that time period, which is over 3 times its share repurchase target for the third quarter.

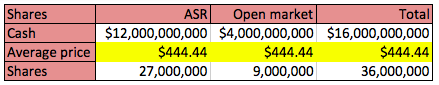

As Philip Elmer-Dewitt so rightly puts it into words, “Last quarter, Apple finally made a major acquisition. And what did it buy? It bought Apple.” Apparently, the Cupertino technology giant spent $16 billion last quarter ($4 billion in cash, $12 billion through the so-called accelerated share repurchase program) to purchase 36 million of its own shares at an average price of just over $444.

For that kind of money, Apple could buy Nokia. Or BlackBerry three times over.

“One way to think of it,” Asymco’s Horace Dediu says in his Apple Q3 RY13 Review, “is this is Apple’s greatest acquisition ever.”

Most of those shares — about 22 million — were retired in fiscal Q3, leaving Apple with 908 million shares outstanding, according to its latest 10-Q. The rest will be retired in Q4.

According to Asymco’s report, Apple shares traded between $390 and $463 during the quarter so it’s hard to know exactly how much Apple paid for them. However at an average of $426.5 per share, Apple would have spent at least $9.3 billion.