Intuit GoPayment Introduces New Credit Card Reader For iOS Devices In Canada

Smartphone payment player Intuit, which recently launched Intuit GoPayment mobile payments system in collaboration with AT&T, has just introduced an all new credit card reader for iOS devices. Best of all, the new card reader comes free when you sign up with the service and its official launch is kicking off first with Canada. The swipe card reader will sit atop any iPhone, iPod or iPad helping small businesses accept credit card payments on-the-go.

Here is the official press release via Engadget:

GoPayment Goes Global – First Stop Canada;

Unveils Newly Designed, Free Credit Card ReaderCanadians Will Be Able to Easily Accept Credit Cards on Mobile Devices;

Innovative Card Reader Improves Sales, Protects DataMOUNTAIN VIEW, Calif. – Jan. 10, 2012 – Canadians and new GoPayment users in the U.S. can soon easily accept credit cards on a mobile device with the GoPayment app and a newly-designed, free credit card reader.

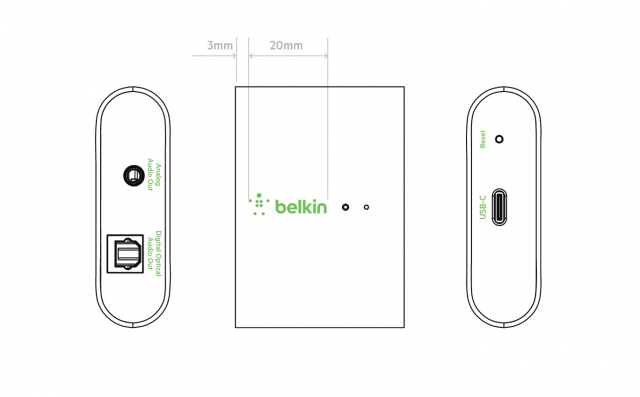

New GoPayment Card Reader

The GoPayment card reader will be available in both the U.S. and Canada. It attaches to the audio jack of most popular iOS and Android devices. It is designed for use on the go and addresses many of the problems and challenges that users confront when using competitors’ card readers. It features a silicone sleeve that conforms to the phone or tablet to provide stability support to keep the reader from moving or spinning when swiping a card. Similar products typically spin on the audio jack, causing misreads of the credit card and requiring the user to awkwardly hold the product in place while swiping.

In addition, Intuit improved the swipe channel to read cards accurately the first time by putting it on an angle, beveling it and making it longer. These features help ensure an accurate read so a business owner doesn’t have to swipe the card multiple times and potentially lose a sale and look unprofessional.

The reader and the northward expansion will be available in “early 2012” with a high-end encryption that protects a customer’s sensitive credit card data from the moment a card is swiped.