Apple Introduces ‘Made for Business’ Program in Select Stores

Apple is set to roll out a new initiative, "Made for Business," starting this May, aimed at assisting small business owners and entrepreneurs globally.

Today Apple announced record-breaking revenues and iPhone and iPad sales, in their 2011 third quarter. In after hours trading, their stock even exceeded $400 US/share, reflecting the non-stop momentum of the past few years.

Thinking back to when world was coming to an end in the Fall of 2008, and Apple shares were available at $82 US/share. Apple stock was there and ready for the taking. Even when the worldwide economy started to rebound, the stock was still within reach for many.

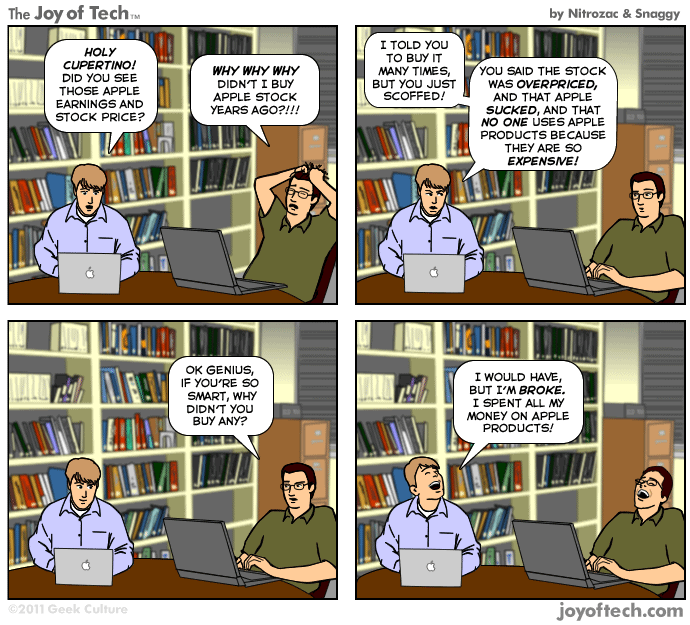

Why haven’t we purchased any shares since then? The Joy of Tech reminds us below:

Brilliant.