Apple Responds to Allegations of Offshore Tax Shelter Strategy in Jersey

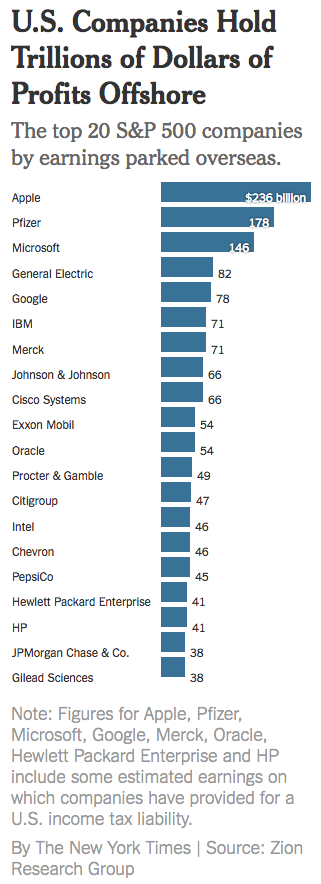

Today the International Consortium of Investigative Journalists with the New York Times and other media partners, released the ‘Paradise Papers’, which documented how corporations like Apple allegedly dodged taxes by moving profits to offshore havens.

In Apple’s case, leaked documents claimed the iPhone maker had decided on the island of Jersey in the English Channel, as its place of choice to hold profits.

Apple has responded in a press release titled The Facts About Apple’s Tax Payments, where it says as the world’s largest taxpayer, they “follow the laws, and if the system changes we will comply.” Apple says it has paid $35 billion in corporate income taxes over the past three years.

In regards to Jersey acting as the company’s tax haven, Apple had this to say:

When Ireland changed its tax laws in 2015, Apple made changes to its corporate structure to comply. Since then, all of Apple’s Irish operations have been conducted through Irish resident companies. Apple pays tax at Ireland’s statutory 12.5 percent.

As part of these changes, Apple’s subsidiary which holds overseas cash became resident in the UK Crown dependency of Jersey, specifically to ensure that tax obligations and payments to the US were not reduced. Since then Apple has paid billions of dollars in US tax on the investment income of this subsidiary. There was no tax benefit for Apple from this change and, importantly, this did not reduce Apple’s tax payments or tax liability in any country.

Apple concludes to say it “believes comprehensive international tax reform is essential, and for many years has been advocating for simplification of the tax code.”