Apple Pay Plans to Launch in Canada This November: WSJ [u]

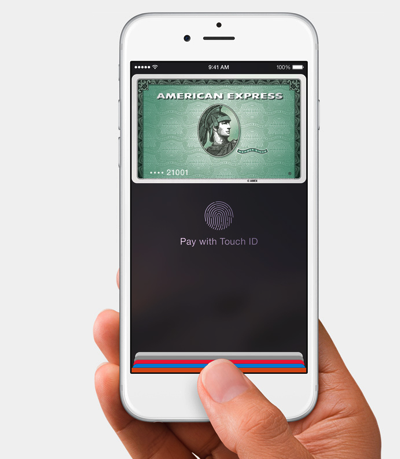

This could be the strongest confirmation Apple Pay is coming to Canada—according to The Wall Street Journal, the mobile payment service is said to launch this fall, marking the first time the service would launch internationally:

Apple Inc. is planning to launch its mobile payments service in Canada this fall, marking the start of its international expansion of Apple Pay, according to people familiar with the matter.

The company is in negotiations with Canada’s six biggest banks about a potential November launch of the service which would enable mobile payments for both credit and debit cards using iPhones and the forthcoming Apple Watch, those people said.

Sources say Apple is in talks with Canada’s biggest banks: Royal Bank of Canada, Toronto-Dominion Bank, Bank of Nova Scotia, Bank of Montreal, Canadian Imperial Bank of Commerce and National Bank of Canada, which accounts for over 90% of retail bank accounts.

Delays in negotiations are said to involve Apple’s fee proposals and potential security vulnerabilities some U.S. banks faced during rollout (in other words, banks not confirming identity fraud). These banks are also worried about Apple Pay’s “onerous” commercial agreements say sources, as potential higher costs could be incurred versus U.S. banks. One source cites a 15 to 25 basis points on credit card transactions to Apple for Canadian banks, versus 15 basis points in the U.S.

However, these ‘Big Six’ banks have collaborated together and hired McKinsey & Co., a consultancy firm to create a security protocol for Apple Pay, say sources, which could help them leverage discussions with Apple.

Canadian banks want Apple Pay to have “secondary authentication” to verify a customer’s identity before credit cards can be used on Apple Pay, meaning one extra tedious step to setup the service and potentially a higher cost for financial institutions.

People familiar with the matter say talks are ongoing and it’s uncertain all six banks will debut Apple Pay at the same time.

This is by far the biggest confirmation Apple Pay is in the works for Canada, as previous rumours cited a March launch but never materialized. Apple Pay is a crucial feature missing for Canadians using the iPhone 6, iPhone 6 Plus and soon Apple Watch, set to arrive next week for initial pre-orders.

If Apple Pay were to arrive in the fall, it would make sense for the announcement to come during Apple’s next iPhone special event. Are you excited for Apple Pay in Canada? Some eager Canadians are already using the service unofficially here with their approved U.S. credit cards, as most point-of-sale terminals here already support NFC, which is a requirement to support Apple Pay.

…more to follow