EU Commission Orders Apple to Repay $14.5 Billion in Illegal Tax Benefits

Ireland has been granting Apple undue tax benefits; therefore, the iPhone maker has to pay up to €13 billion ($14.5 billion) in back taxes to the Irish government, the European Commission has ruled today.

After two years of in-depth investigation of Apple’s tax affairs in Ireland, the EU Commission has concluded that two tax rulings issued by Ireland to Apple have “substantially and artificially lowered” the tax the iPhone maker has paid in the country since 1991.

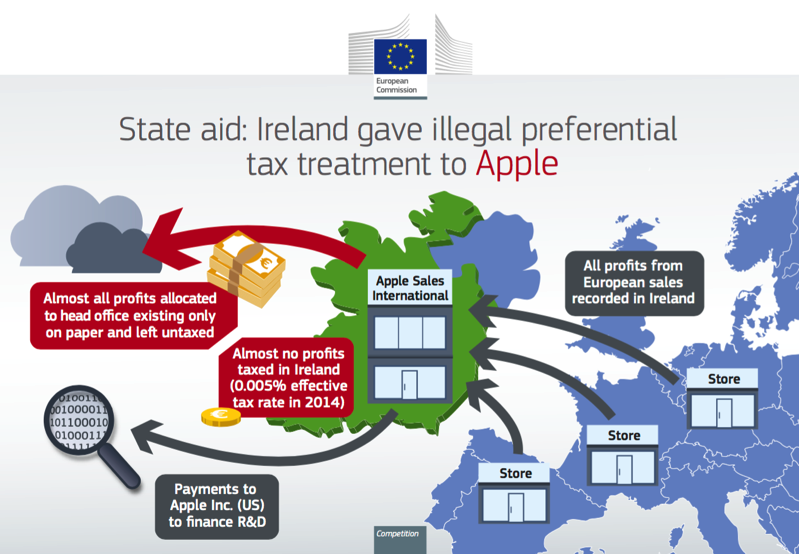

Commissioner Margrethe Vestager, in charge of competition policy, said: “Member States cannot give tax benefits to selected companies – this is illegal under EU state aid rules. The Commission’s investigation concluded that Ireland granted illegal tax benefits to Apple, which enabled it to pay substantially less tax than other businesses over many years. In fact, this selective treatment allowed Apple to pay an effective corporate tax rate of 1 per cent on its European profits in 2003 down to 0.005 per cent in 2014.”

The Irish ruling gave the green light for Apple to establish the taxable profits for two Irish incorporated companies of the Apple group (Apple Sales International and Apple Operations Europe), which didn’t correspond to economic reality, since almost all sales profits recorded by the two Irish companies were internally attributed to a “head office”, which existed only on paper, the press release issued by the EU Commission reads.

The issue is that these “head offices” existed only on paper so they couldn’t generate such profits, and that those profits allocated to these “head offices” were not subject to tax in any country under specific provisions of the Irish tax law, which are no longer in force.

Therefore, a calculation of the tax rate Apple has effectively been paying shows that Apple’s tax rate declined from 1% in 2003 to 0.005% in 2014 on the profits of Apple Sales International. Since tax sweetheart deals are illegal under EU state aid rules, the Commission has instructed Ireland to recoup the illegal state aid it gave to Apple between 2003 and 2014. The amount outlined by the commission is $14.5 billion, plus interest.