Apple Supplier Foxconn Places $5.3 Billion Sharp Takeover Bid

Apple’s biggest assembly partner, Foxconn, has offered $5.3 billion to take over the struggling display manufacturer Sharp, the Wall Street Journal reports, citing sources familiar with the matter.

The offer is much higher than the one presented by Innovation Network Corp. of Japan, a government-backed investment fund, as Foxconn wants Sharp’s creditors to decide based on the economic benefits of the deal rather than political reasons, one source said to the WSJ. INCJ is said to be the preferred buyer, as it would keep Sharp under Japanese control.

Sharp turned to the Mitsubishi UFJ and Mizuho Financial Groups to borrow up to ¥600 billion ($5 billion) and in March has to repay about $4.35 billion.

According to sources, Foxconn has no plans to replace Sharp’s top management, a step meant to persuade Japanese officials worried about a foreign takeover. Sharp and its lenders hope to decide which offer they take by February 4, when the company is set to announce its latest quarterly earnings.

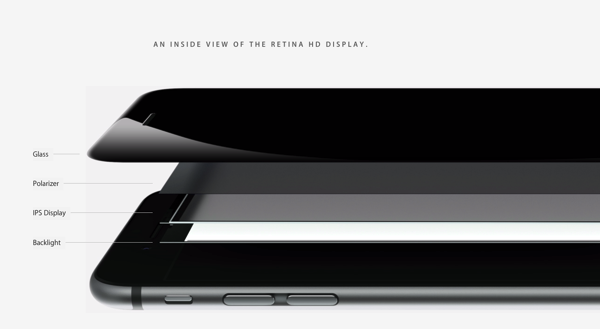

Sharp is responsible for supplying display panels for iPhones but had to turn to the banks to compensate its financial losses. Due to lower than expected Chinese demand for smartphone displays, the manufacturer continued to lose money, and in the most recent half-year result Sharp reported an operating loss of ¥25.2 billion ($210 million).

Foxconn CEO Terry Gou already owns a 38% stake in a Sharp display facility based in Sakai, Japan.