Square Canada Sees Higher Adoption Rate, Transactions Compared to the US

The mobile payment system Square Canada launched back in October of 2012 and so far has proved to be quite popular, with activations and average transactions higher compared to its US counterpart. Square, as you may recall, is the company backed by Twitter founder, Jack Dorsey.

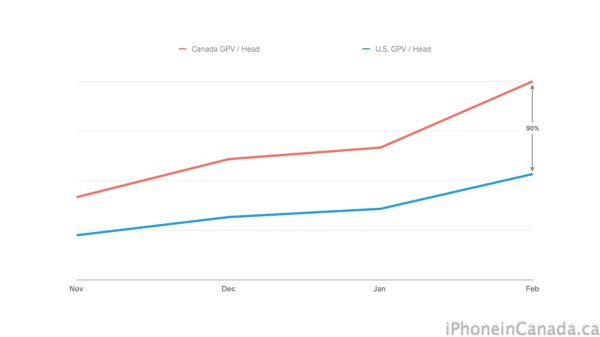

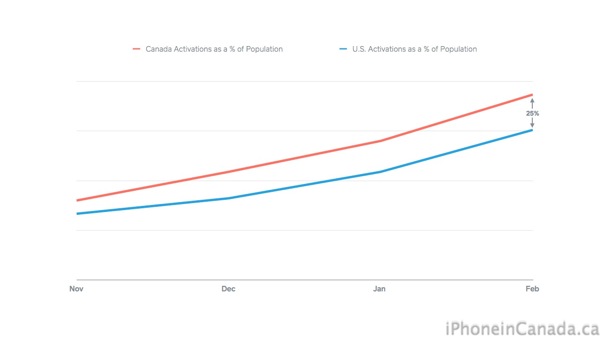

Five months into the Canadian market, their first international market, Square informs us they are seeing more activations here at this time than they did in the USA, with an adoption rate that is 25 per cent higher per capita. Moreover, the company notes gross payment volumes are 90 per cent higher per capita as well, as illustrated in the charts below:

Average Canadian transactions are $120 here, versus $70 at this time in the US, related to services and retailers making up the bulk of activations, which typically have higher transaction sizes. Compared to the US launch, the company saw smaller transactions as more individuals signed up (i.e. food trucks, cart merchants), and as the weather turns Square looks to see a similar adoption in Canada.

Square is seen differently in Canada, as their pricing model is most appealing here, whereas compared to the US launch in October of 2010, their mobile solution was the most attractive. Square readers have also made their way into Canadian retail outlets faster than the US (it took 9 months to hit retail), as now over 250 stores offer the card readers, available at stores such as Future Shop and Best Buy.

Later this year, Square Wallet will make its way into Canada, a mobile payment solution set to be “as easy as saying your name.” No specific timeframe was provided when we inquired, nor was any comment made regarding Passbook integration for Square Wallet.

Are you using Square in Canada right now?