35% of Canadians Regularly Used Contactless Payments via Mobile in 2018: Report

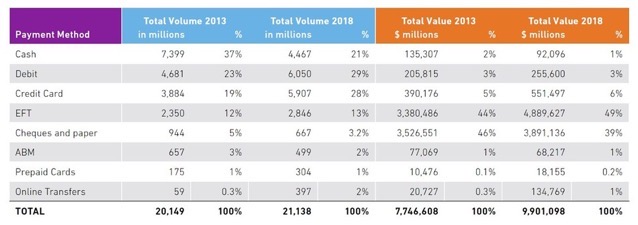

According to Payments Canada’s annual Canadian Payments Methods and Trends Report, which analyzed the 21.1 billion payment transactions totalling more than CA $9.9 trillion in value made in 2018, mobile devices were used by nearly 35% of Canadians for contactless payments regularly.

The study found that Canadians are rapidly adopting newer digital channels, such as contactless, e-commerce, mobile and online transfers, in favour of more traditional ‘paper and coin’ payments.

While contactless mobile payments represented a slower uptake than contactless cards, the overall trend of contactless payments grew 30% year-over-year from 2017-2018.

Similarly, electronic payments accounted for 73% of total payments volume and 59% of total payments value, whereas cash payments saw a decline of 40%.

“We are at a pivotal moment, with a number of key driving forces that are accelerating the transformation of Canada’s payment environment,” said Cyrielle Chiron, Payments Canada’s Head of Research and Strategic Foresight. “Evolving technology and industry innovation are changing the game, fuelled by consumer and business demands for friction-free, fast and secure payments.”

The study also pointed out that concerns about security remain the key barrier for contactless mobile payments, with less than a third of consumers expressing their belief that mobile payments are safe and secure.