Apple Unveils ‘Apple Pay Later’ for Interest-Free Instalments in the U.S.

Apple announced the launch of ‘Apple Pay Later’ in the United States, a new feature that enables customers to split purchases into four interest-free payments over six weeks without any additional fees. The feature was first announced at WWDC in 2022.

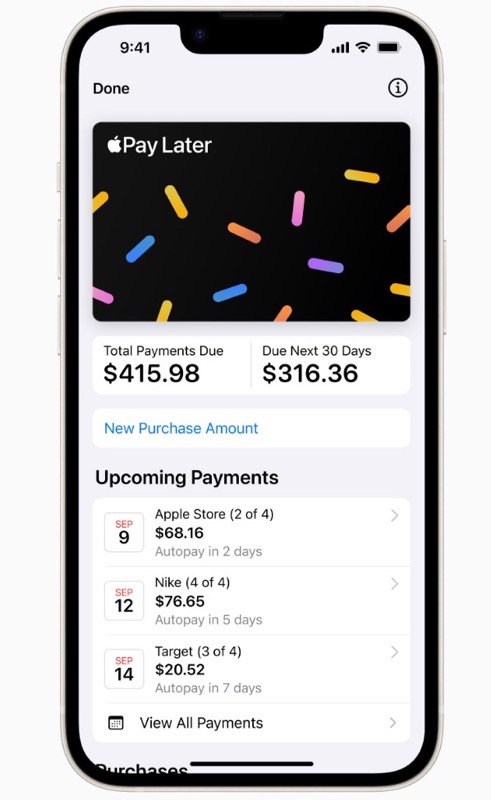

The iPhone maker says this solution aims to support users’ financial well-being and can be easily managed through the Apple Wallet app. Apple Pay Later loans range from $50 to $1,000 and can be used for online and in-app purchases with merchants that accept Apple Pay.

“There’s no one-size-fits-all approach when it comes to how people manage their finances. Many people are looking for flexible payment options, which is why we’re excited to provide our users with Apple Pay Later. Apple Pay Later was designed with our users’ financial health in mind, so it has no fees and no interest, and can be used and managed within Wallet, making it easier for consumers to make informed and responsible borrowing decisions,” said Jennifer Bailey, Apple’s vice president of Apple Pay and Apple Wallet, in a statement on Tuesday.

Apple will soon offer a prerelease version of Apple Pay Later to selected users, with plans to extend the feature to all eligible users in the coming months.

To get started, users can apply for a loan within the Wallet app without affecting their credit. Once approved, they will have the option to select Apple Pay Later at checkout online and in apps on iPhone and iPad. All loans can be viewed, tracked, and managed within the Wallet app, offering a seamless experience, says Apple.

Purchases made using Apple Pay Later are authenticated via Face ID, Touch ID, or passcode, and users’ transaction and loan history are not shared or sold to third parties for marketing or advertising purposes. Apple Financing LLC, an Apple Inc. subsidiary, is responsible for credit assessment and lending, and will report Apple Pay Later loans to US credit bureaus starting this fall.

The Mastercard Installments program powers Apple Pay Later, and merchants that already accept Apple Pay do not need to make any changes to enable the new feature for their customers. Goldman Sachs serves as the issuer of the Mastercard payment credential used to complete Apple Pay Later purchases.

Apple Pay Later is currently available for online and in-app purchases on iPhone and iPad with iOS 16.4 and iPadOS 16.4. Invitations to access the prerelease version will be sent to randomly selected users via Wallet and their Apple ID email.

Again, with Apple Card and its cash-back perks, and now Apple Pay Later exclusive to the U.S., it’s unlikely we’ll ever see these features in Canada. Apple Card launched back in 2019 in the U.S. and it’s clear by now big Canadian banks will never cede control of customer purchase experiences and consumer data to Apple.