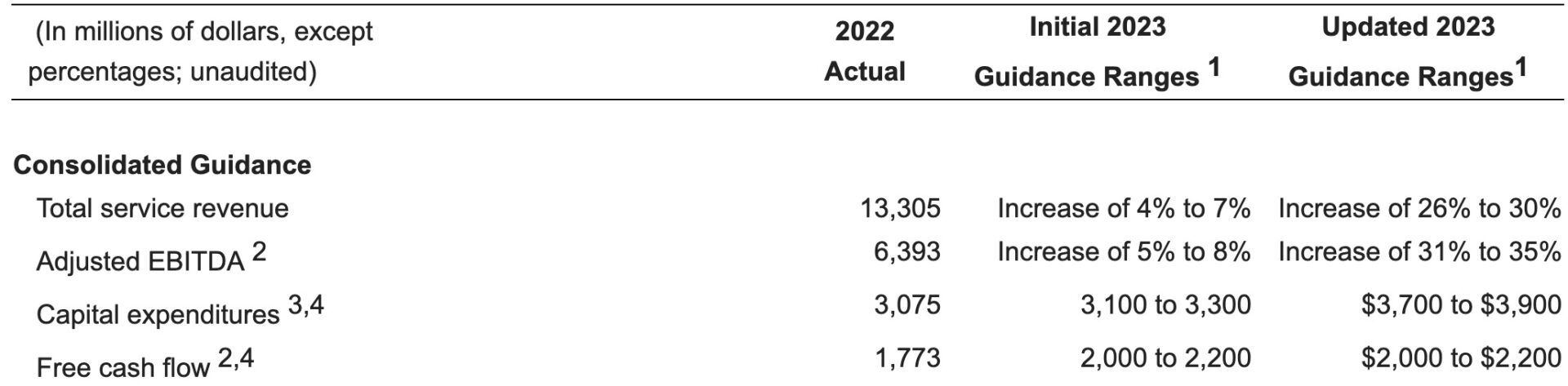

Rogers Now Expects 26-30% Increase in Service Revenues with Shaw Secured

Rogers has updated its 2023 financial guidance ranges to reflect its expected acquisition of Shaw which was overwhelmingly approved by the federal government on Friday morning.

The company said on Friday morning that its total service revenue is expected to increase by 26% to 30%, while adjusted Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) is expected to increase by 31% to 35% compared to its initial 2023 guidance ranges provided on February 2, 2023.

Rogers said the updated 2023 guidance ranges are based on various assumptions, including the continued competitive intensity in all segments, the closure of the Shaw Transaction by April 7, 2023, and the realization of anticipated cost synergies, operating efficiencies, and other benefits of the transaction.

The assumptions also include wireless customers continuing to adopt higher-value smartphones, and overall wireless market penetration in Canada growing at a similar rate as in 2022, to go with no more significant additional legal or regulatory hurdles.

The company also expects continued subscriber growth in the internet, declining television subscribers, growth in sports and relative stability in other traditional media businesses.

In regards to capital expenditures, Rogers says it will continue investing in expanding its 5G wireless network and upgrading its hybrid fiber-coaxial network.

The updated guidance ranges are subject to change depending on economic conditions and other factors, said Rogers.