Apple’s Dependence on China Increasing Despite Impending Tariffs

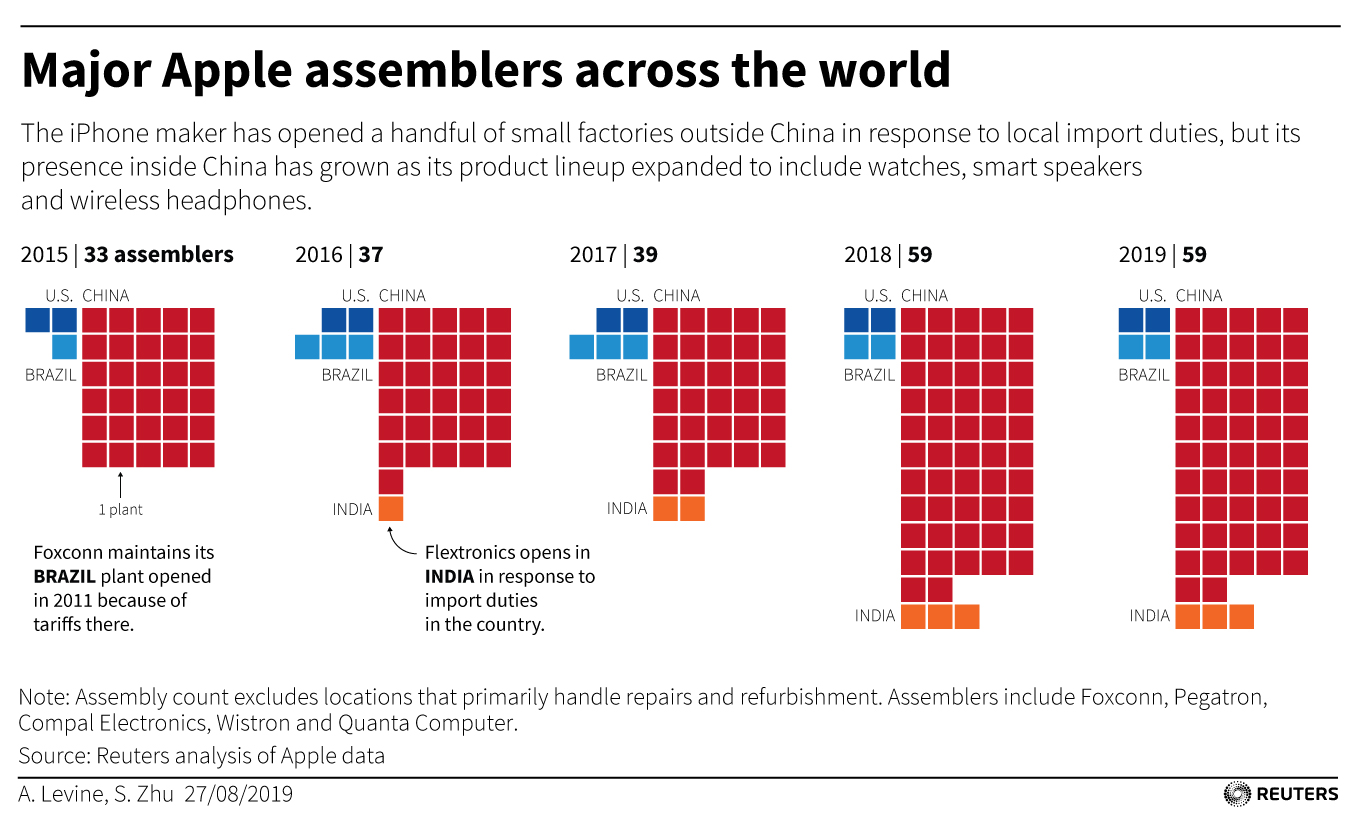

Apple may be trying to wean itself off manufacturing in China, but despite its use of factories in Brazil and India, the Cupertino, California-based tech firm is actually relying on China more than ever.

A new report from Reuters analyzed five years of Apple data on locations operated by the company’s top 200 suppliers by spend.

While Apple and its biggest supplier, Foxconn, have said that it could meet the U.S. iPhone requirements from factories outside of China, Reuters‘ results suggest otherwise.

Contract factories that make components for various Apple products are concentrated in China, with 47.6% factories located in the country. While some of the component makers do have their factories in Brazil and India, they are only meant to meet local demand.

Overwhelmingly, the analysis shows that most of Apple’s contract work involves companies working in China. This covers the companies which “sell it chips, glass, aluminum casings, cables, circuit boards and much more.” In 2015, 44.9% of Apple’s suppliers were in China. This year, that figure stands at 47.6%.

When Apple has contracted new factories to carry out work, more of these have been in China. For instance, Foxconn has expanded from 19 factories in 2015 to 29 in 2019, while Pegatron, meanwhile, has expanded from eight to 12.

As Trump’s incoming China tariffs are just around the corner, Apple’s increasing dependence on Chinese production puts the company in an economically difficult situation. Tariffs on AirPods, Apple Watches, and HomePods are scheduled to take effect on September 1, while a levy on iPhones and iPads is set for December 15.