Apple Annual Report Shows R&D Spend Has Grown by $1.1 Billion

According to Apple’s recently filed annual 10-K report with the SEC, the company has spent $1.1 billion on R&D and has added about 12,000 full-time workers (via iLounge). The Cupertino giant has spent a total of $4.48 billion on R&D during 2013 so far, which shows a 32% increase from last year’s $3.38 billion expenditure.

The report also reflects that Apple now has 80,300 full-time employees, as compared to 72,800 from last year, out of which approximately 42,400 employees worked in the company’s retail segment. Furthermore, Apple has also revealed its plans on opening “about 30 new retail stores” globally during the next year, with two-thirds of those stores to be located outside the United States. The company also pans on spending $9.15 billion on capital expenditures such as “product tooling and manufacturing process equipment” after paying out $9.5 billion on such costs last year.

Some of the other data points from the report worth highlighting include:

- As of September 29, 2012, the Company had $121.3 billion in cash, cash equivalents and marketable securities, an increase of $39.7 billion or 49% from September 24, 2011.

- During 2012, the Company’s domestic and international net sales accounted for 39% and 61%, respectively, of total net sales.

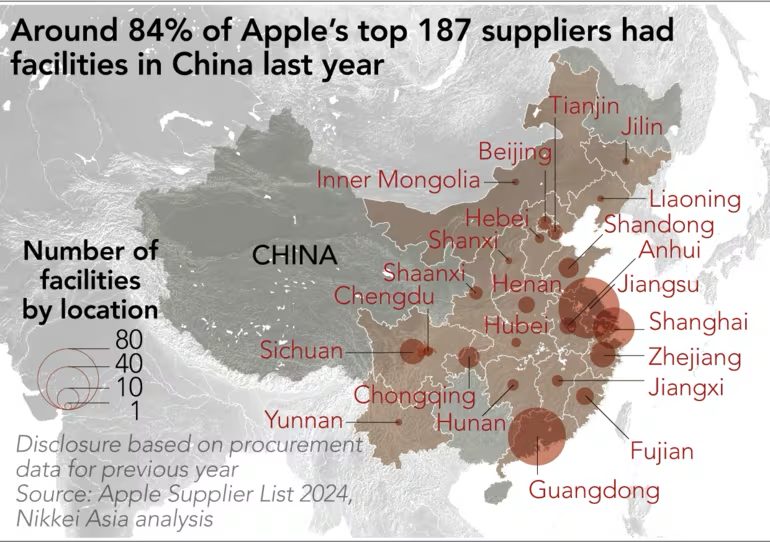

- Substantially all of the Company’s hardware products are manufactured by outsourcing partners that are located primarily in Asia. Although the Company works closely with its outsourcing partners on manufacturing schedules, the Company’s operating results could be adversely affected if its outsourcing partners were unable to meet their production commitments.

- No single customer accounted for more than 10% of net sales in 2012, 2011 or 2010.

- The Company remains subject to significant risks of supply shortages and price increases. The Company expects to experience decreases in its gross margin percentage in future periods, as compared to levels achieved during 2012, largely due to a higher mix of new and innovative products with flat or reduced pricing

- The gross margin percentage in 2012 was 43.9%, compared to 40.5% in 2011.

- The Company’s actual cash payments for capital expenditures during 2012 were $8.3 billion

For full 10-K report, follow this link.