Apple Card Wins Another J.D. Power Award, Still Not in Canada

Apple Card has once again secured its title as the Best Co-Branded Credit Card for Customer Satisfaction with No Annual Fee, an award from J.D. Power for its 2023 U.S. Credit Card Satisfaction Study. This is the third year in a row that Apple Card, which is backed by Goldman Sachs, has won the award.

“Since the start, we’ve been committed to delivering tools and services that help users live healthier financial lives, and it’s been rewarding to see customers using and finding value in the benefits of Apple Card. We are honoured that Apple Card has been recognized as a leader in customer satisfaction,” said Jennifer Bailey, Apple’s vice president of Apple Pay and Apple Wallet, in a statement on Thursday.

“In partnership with Goldman Sachs, we are continuously working to expand the value users receive from Apple Card, most recently with the launch of Savings, and we look forward to continuing to develop tools and services that put our users and their financial health first,” added Bailey.

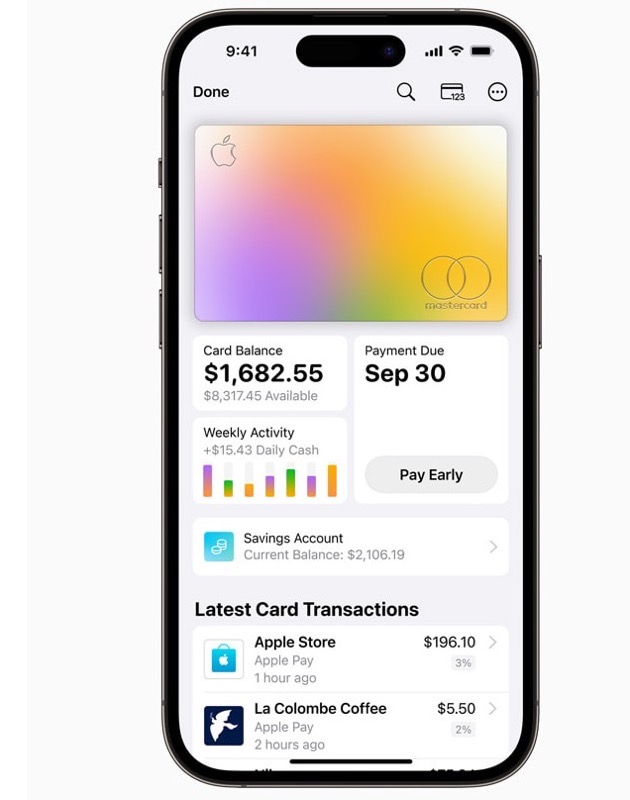

Apple Card, which made its debut in 2019, was created with a vision of promoting financial well-being for its iPhone users. A standout feature is its lack of fees, combined with tools that allow users to seamlessly monitor purchases, manage expenses, and determine possible interest charges. Users also enjoy up to 3% Daily Cash on every purchase.

“With Apple Card, we have had a shared focus on delivering a great experience and providing value to our customers since the beginning,” said Liz Martin, Goldman Sachs’s head of Enterprise Partnerships, in a statement. “As we have brought new offerings and benefits to customers, we are honoured to once again be recognized by them and J.D. Power.”

Adding to its list of features, Apple recently rolled out a Savings account for Apple Card users via Goldman Sachs. This account has garnered significant interest, accumulating over $10 billion in deposits in a short span. The Savings feature is aligned with Apple Card’s principle of maximizing user value, particularly with the Daily Cash rewards. Savings comes with no fees, zero minimum deposits, or balance prerequisites, and it offers the flexibility of transferring funds from linked bank accounts.

Of course, Apple Card is only available in the U.S. and it’s unlikely to see a debut in Canada, in our lifetimes (and those of our children, grandchildren and great grandchildren). But earlier this year, American Express was rumoured to be taking over the Apple Card portfolio, with the former the first to support Apple Pay in Canada.