CRA Alleges Iristel Involved in Sham Carousel Scheme

The Canada Revenue Agency (CRA) suspects a $63-million error in tax refunds, linking it to a “sham” carousel scheme allegedly involving Iris Technologies, the parent company of Iristel.

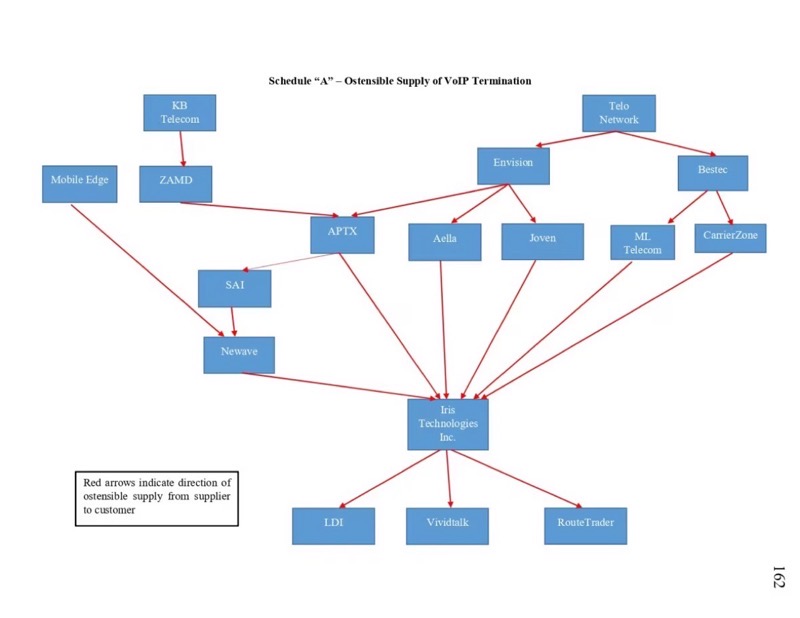

Based in Markham, Ontario, Iris Technologies, under CEO Samer Bishay, reportedly inflated its sales from $27 million to $800 million within two years, primarily through trading bulk internet telephone minutes. This surge in sales positioned the company to claim over $120 million in tax refunds, raising red flags at the CRA, reports CBC News, which also recently investigated the alleged scheme on CBC’s The Fifth Estate.

The CRA’s court filings suggest Iris Technologies might have been knowingly involved or “wilfully blind” to its participation in the carousel scheme. This sophisticated tax fraud involves circulating goods among companies, exploiting sales tax discrepancies, often with transactions existing only on paper.

Bishay, a notable figure previously recognized as one of Canada’s top 25 immigrants, has denied these allegations. He has initiated multiple appeals in various federal courts and is suing the CRA for $275 million, alleging abuse of process and misfeasance.

Investigations by The Fifth Estate and Radio-Canada’s Enquête into carousel schemes unveiled a complex web of international criminal networks exploiting Canada’s tax system.

Key elements of these schemes included cryptocurrency transactions, false invoices, and corporate filings across North America and Europe. Iris Technologies, at the heart of this case, reportedly shifted to using a cryptocurrency-based platform, TeleEscrow, for its transactions, further complicating the situation.

The case raises questions about Canada’s preparedness to combat carousel fraud, a major issue in the EU, costing billions in tax losses annually. Critics argue that Canada’s tax system remains vulnerable to such fraud, with authorities often lagging in response.

The CRA’s handling of Iris Technologies’ tax refund claims has also come under scrutiny. Initially, the agency “curtailed” its audit of Iris due to alleged “pressure” from the company, releasing significant tax refunds. However, upon further investigation and refusal to pay an additional $86 million in claimed refunds, the CRA reopened the case.

“What we’ve seen in this scenario that they allege is a fraud,” Bishay said to CBC News, adding, “is nothing more than the hallmarks of our industry, and they label it as the badges as fraud, which I don’t understand how they could.”

Iristel sued the CRA for $275 million in 2022, claiming it was abusing its power.