Fidelity Investments Marks Down Value of Elon Musk’s X, Dropping 71.5%

Fidelity Investments has once again marked down the value of its shares in X (formally Twitter) Holdings. This represents a strong decline in value as far as how Fidelity values its stock in the company.

According to Axios, Fidelity’s valuation on its shares in X has fallen 71.5 percent less than at the time of purchase. These figures stem from a reported disclosure that runs through the end of November 2023. Fidelity reveals its re-evaluation of private shares each month with a 30-day delay. In October 2023, the fund manager made a valuation cut of 65 percent.

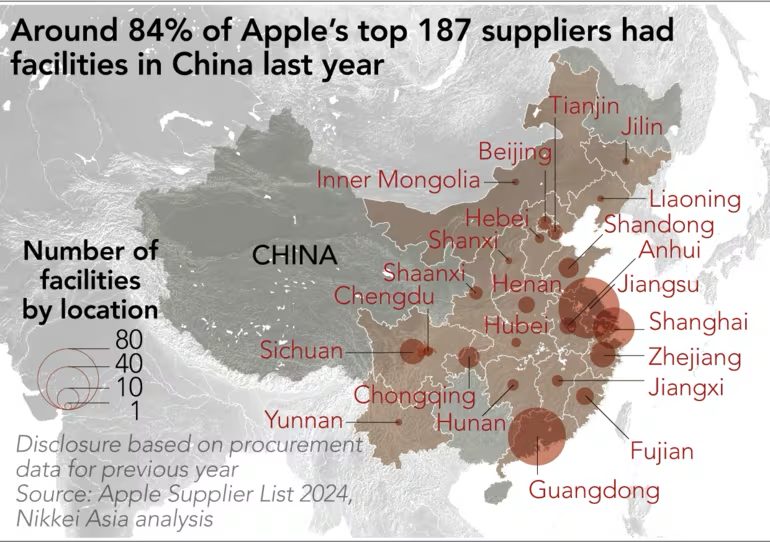

The latest drop in value includes a 10.7 percent cut in November. This comes during the same month that X owner Elon Musk sat on stage with the New York Times and told advertisers to “go f*ck yourself.” This comment was directed towards the likes of Disney CEO Bob Iger, who decided to pull ads and affiliations from the platform following recent antisemitic posts. Other boycotting advertisers include Apple, Lionsgate, IBM, and more.

Last month, the Financial Times reported that X may look to appease smaller businesses to spend ad dollars on X.

Fidelity has been marking down its shares in X in the months following Musk’s company purchase. However, the financial corporation did keep its share value stable in the early months of 2023. It’s worth noting that while Fidelity is one of the shareholders in the private business, it doesn’t share inside information on X’s current financial situation. This report does not reflect the company’s overall evaluation.

In November, Meta’s stock rose by 4.9 percent. Additionally, Snap’s shares rose by 38.2 percent. Both are publically traded companies.