Analyst Says Apple’s Stock Could Surge Another 27% in the Next 12 Months

According to Daniel Ives of Wedbush, Apple’s stock has the potential to gain another 27% in the next 12 months, Business Insider is reporting. “We still believe the stock has a lot of gasoline left in the tank with an iPhone 12 ‘supercycle’ on the near term horizon,” the analyst wrote in a research note.

Earlier the week, Apple became the first U.S. publicly traded company to top a staggering $2 trillion in market value, after its shares topped $467.77 USD. With an “outperform” rating on the stock, Ive’s now has AAPL’s price target of $515 and a bull case of $600, which is 27% higher than where Apple closed yesterday.

The upcoming iPhone 12 5G launch is also one of the most significant product cycles for Apple, according to Ives.

Even against a soft backdrop due to COVID-19, “Apple has a ‘once in a decade’ opportunity over the next 12 to 18 months as we estimate roughly 350 million of Cupertino’s 950 million iPhones worldwide are in the window of an upgrade opportunity,” Ives wrote.

Baked into Ives’ bull thesis is Apple’s services business, which he values between $700 billion to $750 billion and thinks will generate more than $60 billion annual revenue in 2021.

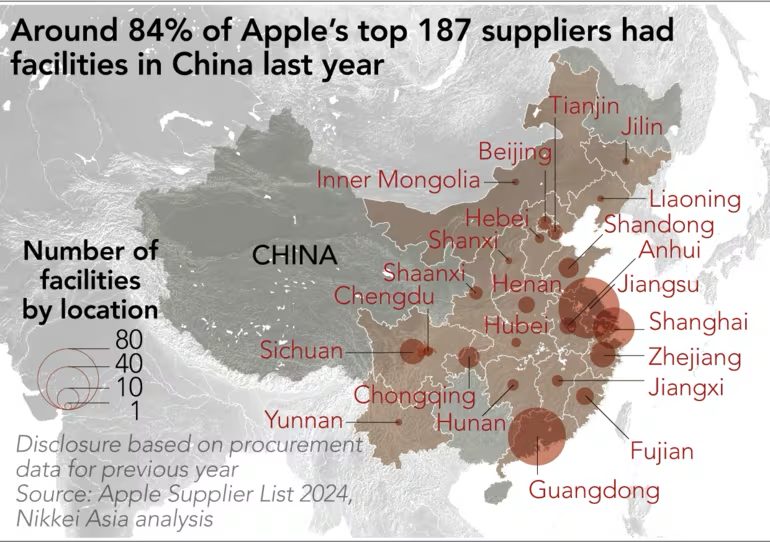

Moreover, Ives is expecting a considerable boost from China, which he estimates will account for roughly 20% of iPhone upgrades in the coming year.