CIBC CEO: No Timeline for Apple Pay in Canada, But Arrival “An Inevitability”

CIBC CEO Victor Dodig spoke to a Bay Street crowd at lunchtime in Toronto to note game-changing technology players and services such as Apple Pay are causing banks to reinvent themselves from “top to bottom,” reports The Financial Post.

These modernization plans will see CIBC “transform legacy platforms, organizations and cultures,” to keep up with innovators by “embracing and deepening collaboration and strategic partnerships with outside innovators, [and] working with new tech partners and networks,” reiterating the bank’s announcement this morning to back Rogers’ suretap mobile wallet, similarly supported by TELUS and Bell.

Dodig also stated there is no timeline for Apple Pay’s launch in Canada, despite a recent rollout in the UK, but did say the arrival of the iPhone maker’s mobile wallet is “an inevitability” here, along with other new payment systems:

“In 18 months time, I think all the relevant participants that have relevant technology that are either in the Android space, in the BlackBerry space, in the Apple space, will play a role in the financial ecosystem,” he said.

From CIBC’s point of view, traditional banking isn’t going anywhere, as the bank will continue to rely on “deepening client relationships by being innovative in developing the channels our clients use every day.”

TD Bank earlier this year said Apple Pay in Canada is “ultimately Apple’s story to tell,” while Scotiabank previously stated it was “working with a broad set of parties” when asked about a relationship with Apple.

Earlier today, Suretap president Jeppe Dorff confidently stated “we are certainly going to beat Apple,” referring to the mobile payment’s “unified, single place to store all your credentials.”

At WWDC this year, Apple announced Apple Pay would now support retailer credit cards and loyalty rewards programs, which is something similar but not exclusive to suretap. The Wall Street Journal reported earlier this year Apple Pay could launch in Canada as soon as November, but negotiations with Canada’s ‘big 6’ banks were still ongoing.

While competition is great for consumers, all of these mobile wallets have one thing in common: they don’t support the iPhone and iOS, which is a dominant platform in Canada.

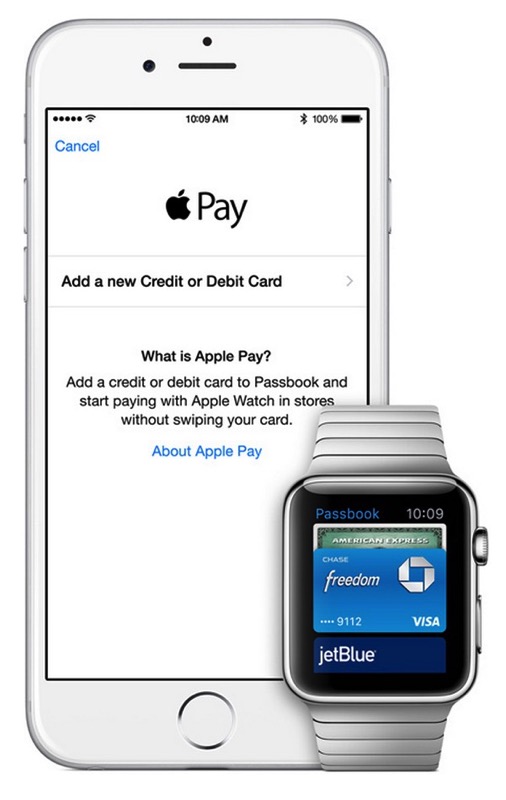

Although Apple Pay is limited to the iPhone 6, iPhone 6 Plus and Apple Watch, Canadians are eagerly awaiting the first bank to support the mobile wallet and many have stated they will flock to the first bank that supports it. Banks aren’t giving customers what they want right now–because clearly consumers want Apple Pay, Android Pay and even Samsung Pay here, but it’s going to take a while for them to arrive.