RBC Mobile App Gains Budgeting Feature Powered by Artificial Intelligence

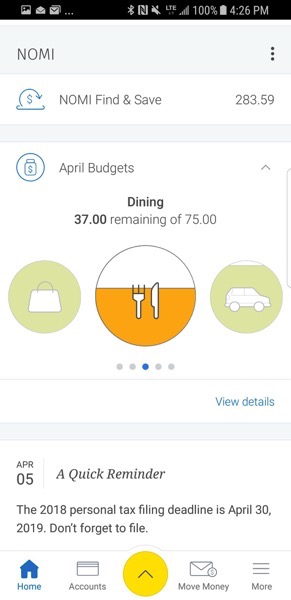

RBC Mobile has been updated with a new budgeting feature powered by artificial intelligence, as NOMI Budgets is now available.

According to the bank, the new feature will “proactively analyze a customer’s spending history, recommend an appropriate budget and send timely updates to help keep them on track in a seamless and convenient way.”

RBC is calling this a “first-of-its-kind in Canada”, with the new feature powered by NOMI Insights, which debuted back in the app in the fall of 2017.

“We know that so many of our clients look for helpful tools and support when it comes to budgeting and managing their day-to-day finances,” said Peter Tilton, Senior Vice-President, Digital at RBC, in a statement. “NOMI Budgets is the latest of our personalized digital capabilities that, using the power of AI, provides our clients with deeper insights that can increase their financial confidence.”

How it Works

NOMI Budgets will provide a customized monthly budget in five categories based on your spending history: Entertainment, Shopping, Cash Withdrawals, Transportation and Dining. Notifications will be sent to users when their spending reaches 50%, 75% and 100% thresholds.

This new feature joins existing AI-powered features NOMI Insights and NOMI Find & Save, with the latter having helped clients save over $83 million, as of February 2019, with RBC noting active users are saving roughly $180 per month on average.

Earlier this month, RBC Mobile debuted the ability to add bills by taking a photo and also for personal clients to lock/unlock a lost debit card. These features are now available for small business customers as well for misplaced credit cards.

Click here to download RBC Mobile for iOS in the App Store.