Apple Card’s First Expansion Might Be in India, Not Canada

Apple is currently negotiating with banks and regulatory authorities in India to introduce its Apple Card credit card, according to sources speaking to MoneyControl.

During his visit to India in April, Apple CEO Tim Cook reportedly met with HDFC Bank CEO and MD Sashidhar Jagdishan to discuss the potential partnership.

The tech giant is also reportedly in discussions with the National Payments Corporation of India (NPCI) to potentially introduce Apple Pay in India, with the specifics of these discussions, whether in relation to Apple’s credit card being powered by NPCI’s Rupay platform or the Unified Payments Interface (UPI), remaining uncertain.

The appeal of launching a Rupay Credit Card lies in its capability to be linked to the UPI, a platform that enables swift, seamless payments through QR code scanning via mobile phones.

The move comes during a period where mobile phone payments are witnessing a significant surge, prompting technology powerhouses such as Apple, Google, Amazon, and Samsung to invest in the expansion of their payment services. These companies have developed their own payment apps, aiming to carve out substantial market share in this sector.

Apple has also reportedly engaged with the Reserve Bank of India (RBI) to discuss the modalities of its proposed credit card, with the regulator advising Apple to adhere to standard protocols for co-branded credit cards without providing any special concessions.

The sources indicated that Apple aims to launch its Apple Card in India as a co-branded credit card with HDFC Bank, although the discussions are still in the early stages and no decision has been reached yet.

Apple currently offers a premium credit card with Goldman Sachs and Mastercard, only available in the U.S. It is unclear whether Apple would be willing to modify its card to meet India’s regulatory standards.

In recent years, Apple has been focusing on India as a key growth market, with iPhone sales showing impressive growth from a low base. The company’s revenue in India reached around Rs 50,000 crore or $6 billion in FY23, marking a 50% increase over the previous fiscal year. A significant portion of these transactions being made through the Apple Card could potentially have a considerable impact.

With Apple’s recent launch of exclusive retail stores in Delhi and Mumbai during Cook’s April visit, as well as shifting a substantial part of its iPhone production to India, the country is set to see nearly a quarter of Apple’s total mobile phone production in the next three to four years.

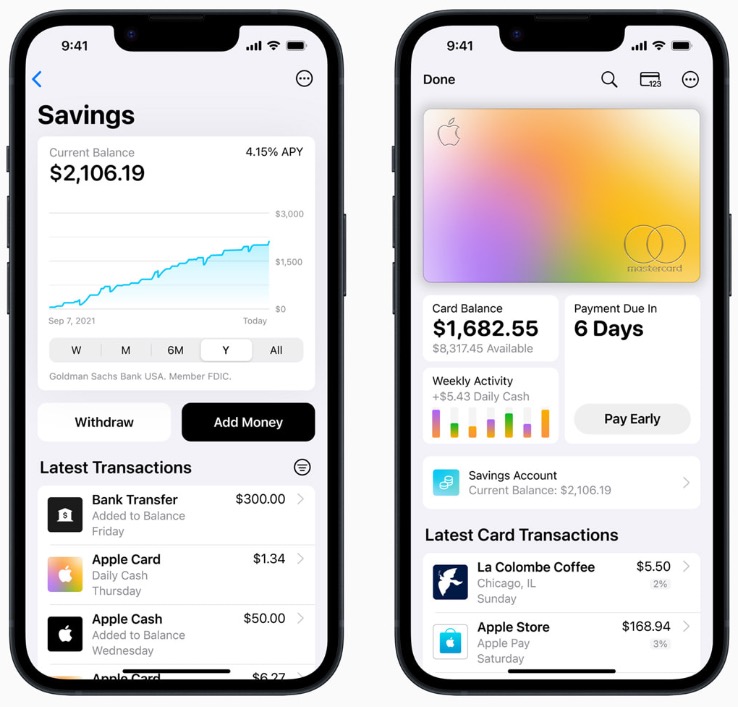

Apple Card, tightly integrated with Apple Pay, offers several appealing features for customers, such as depositing reward money into the Apple wallet with an annual interest rate of 4.15%, no annual fees, and the potential for interest-free installment purchases of Apple products.

However, to launch in India, Apple may need to make some significant compromises to comply with India’s strict regulations around co-branded credit cards, including allowing its banking partner to prominently feature on the card, as well as agreeing not to store customer data on its own platforms.

Apple Card is only available in the U.S. and its first expansion could be in India, instead of its closest neighbour to the north, Canada. Given the tight control of big Canadian banks when it comes to credit cards, it’s unlikely they would cede any control of the customer experience to Apple. We do have Apple Pay here, but that’s just for contactless payments.