Apple Card Users Earned Over $1 Billion in Daily Cash Last Year

Celebrating its fifth year since introduction, Apple Card has announced a major milestone with over $1 billion in Daily Cash rewards earned by its 12 million users last year.

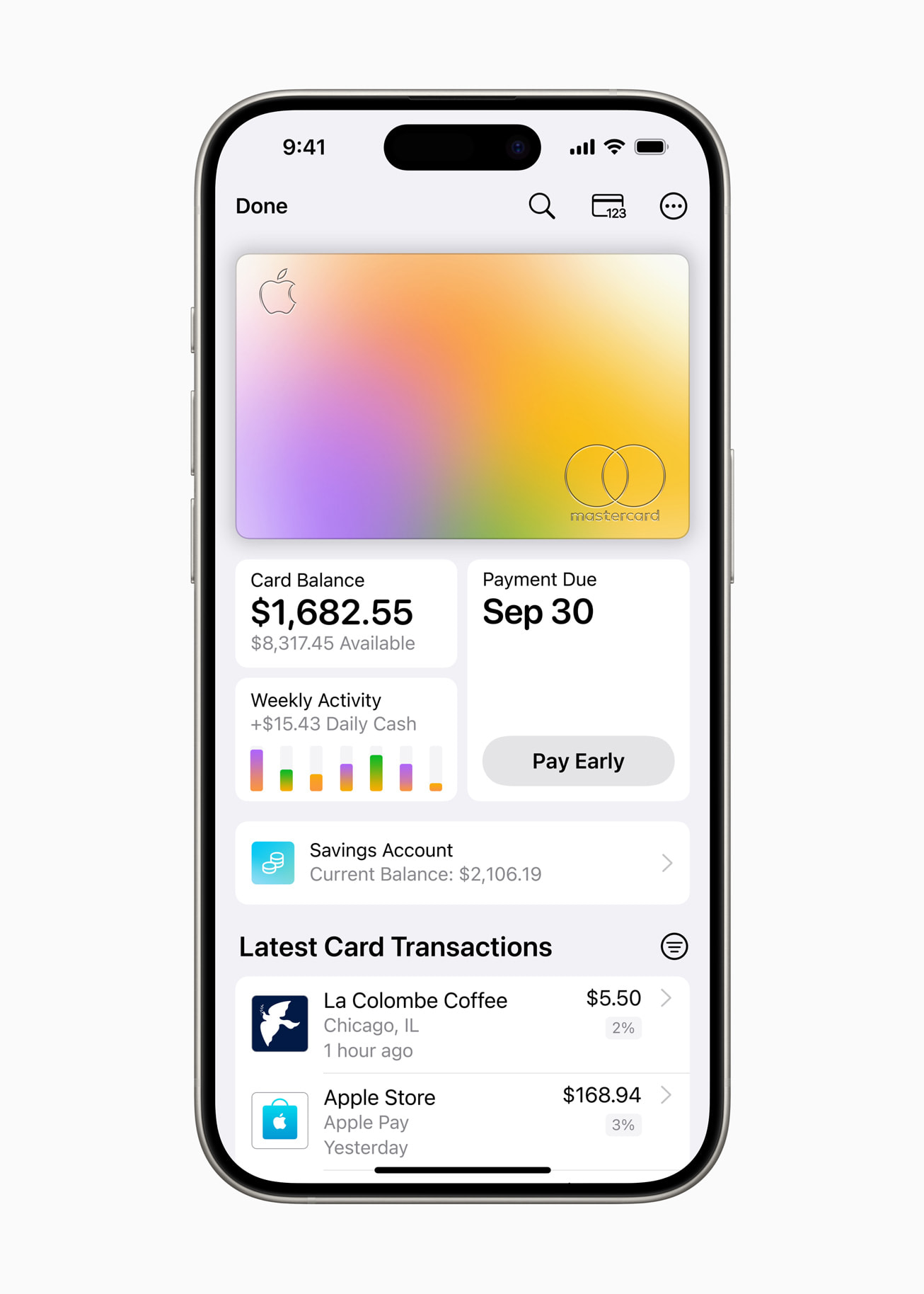

Designed for healthier financial decisions, Apple Card offers digital-first tools, such as easy-to-use spending features and the recently added Savings account, contributing to its award-winning experience.

Jennifer Bailey, Apple’s VP of Apple Pay and Apple Wallet, expressed pride in the positive financial impact on users.

““We’re proud of what we’ve been able to deliver to Apple Card customers in just five years. As we look at the year ahead and beyond, we’re excited to continue to innovate and invest in Apple Card’s award-winning experience.”

Bill Johnson, CEO of Enterprise Partnerships in Platform Solutions at Goldman Sachs, also applauded the customer response, while committing to deliver an even better experience for Apple Card users.

While announcing the latest milestone, Apple has also highlighted the following achievements:

- Maximizing Daily Cash Rewards: Users earned over $1 billion in Daily Cash rewards through Apple Card spending.

- Growing Rewards with Savings: The Savings account garnered over $10 billion in deposits within a few months, with a high-yield APY of 4.50 percent.

- Healthy Financial Decisions: Almost 30 percent of users make two or more payments per month, utilizing Apple Card’s payment tools for informed decision-making.

- Apple Card Family Success: Over 1 million users share Apple Card within Family Sharing Groups, promoting shared credit-building and financial health.

- Path to Apple Card Program: Over 200,000 users enrolled and successfully accessed credit through the Path to Apple Card program, designed to improve financial health.

- Privacy and Security: Recognized as the Best Credit Card for Privacy in 2024 by Bankrate, Apple Card offers real-time fraud protection.

The success of Apple Card is underscored by its recognition as the Best Co-Branded Credit Card for Customer Satisfaction with No Annual Fee in the J.D. Power 2023 U.S. Credit Card Satisfaction Study.

This year also marks the third consecutive year of Apple Card and issuer Goldman Sachs securing the No. 1 ranking in their segment.

Of course, Apple Card is only available in the U.S. and it’s unlikely that we’ll see it launch in Canada anytime soon.