Feds to Proceed with Retroactive Digital Services Tax on Tech Giants

The federal government’s Budget 2024 released on Tuesday has confirmed it plans to proceed with the Digital Services Tax (DST) to target major tech giants, specifically American businesses including the likes of Apple.

This move comes after international efforts to create a single approach to taxing large and profitable corporations, including digital companies, have been met with repeated delays.

“However, in view of consecutive delays internationally in implementing the multilateral treaty, Canada cannot continue to wait before taking action,” said the federal government.

The budget says the “Pillar One” focus will see Canada ensure the world’s largest corporations pay their fair share of taxes in the countries where their users and customers reside. Despite efforts to finalize a multilateral treaty under Pillar One, progress has been slow, prompting Canada to take action on its own.

Initially announced in 2020 and paused until the end of 2023 to allow for international negotiations, the government is now moving forward with its plan to tax digital businesses that profit from Canadian users’ data and content. Bill C-59, which is currently before Parliament, will enact the DST, set to apply from the 2024 calendar year, retroactively affecting revenues from January 1, 2022. You can bet major tech companies won’t be happy about this.

Budget 2024: Any Profit Is Bad. #cdnpoli

— Warren Kinsella (@kinsellawarren) April 17, 2024

The DST is expected to generate an additional $5.9 billion in revenue over five years, starting in 2024-25, say the feds.

Alongside the DST, Canada is also moving ahead with “Pillar Two”, which looks to establish a global minimum tax of 15 percent on multinational corporations’ profits. Following consultations last summer, the government plans to introduce legislation for this plan, which could increase revenues by $6.6 billion over three years beginning in 2026-27.

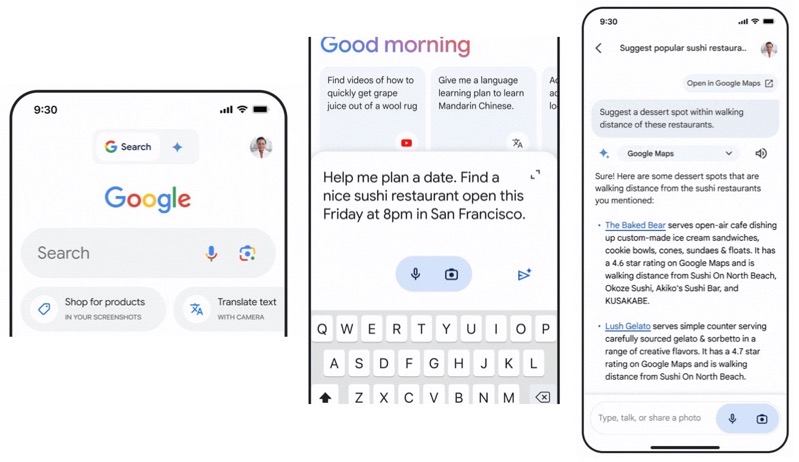

Back in December, U.S. Senators issued stern warnings that Canada must face “consequences” if it moves ahead with its DST, as it discriminates against American digital companies, including the likes of Amazon, Google, Facebook, Uber, and Airbnb. Last summer, the Liberal government (along with Belarus, Pakistan, Russia, and Sri Lanka) said it planned to support the tax, even though 138 countries decided to delay similar measures.