CRTC’s Wireless Code Causes Price Hike for Basic Mobile Plans [Study]

A major change occurred last December: after months of consultation and debate, and other long months of challenges to build upon the already enacted regulations, the New Wireless Code has taken effect.

Canadians have given the code a warm welcome, because it has meant an end to three year contracts and could end wireless contracts without penalty. So, what were the immediate results of the new code? The government-commissioned Wall Report has the details (via Reuters).

As it turns out — and you may have guessed this already — all that glitters is not gold, as the study highlights. According to the study, the code has resulted in an increase in the cost of basic plans, while prices of other plans have dropped.

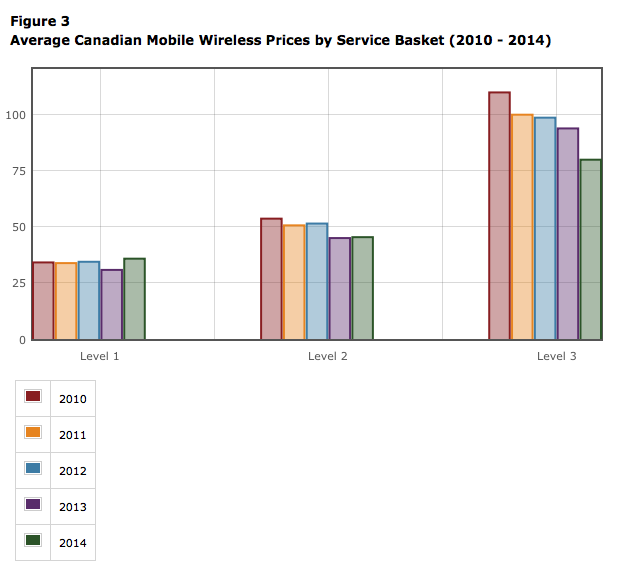

To put that into numbers:

The government-commissioned Wall Report showed the monthly charge for basic mobile wireless service rose to $36 in 2014 from $31 in 2013, and $34 in 2010. High-volume users saw their prices decline to $80 from $94 in 2013, and from $110 in 2010.

“The reduction of contract terms placed upward pressure on service plan prices given there is now a shorter period available to recover the handset subsidies,” said the report, a copy of which was seen by Reuters.

By comparison, wireless startups provide services for up to 49% less than the incumbent players, but they face network limitation issues. This is why they are demanding regulation for domestic roaming charges, which may be ready, but we don’t know when they will take effect.

Update: From the study:

As noted, one of the most significant factors affecting prices this year compared to last is the incumbent’s introduction of new two-year rather than three-year contract term service plans. This factor alone would normally have been expected to place upward pressure on their prices, which seems to be the case for the low-end Level 1 service basket. However, the introduction of unlimited talk and text plans combined with lower data rates appears to have more than offset this upward rate pressure in the case of the Level 3 service basket.

- Level 1: 150 incoming & outgoing minutes per month, with 10% of outgoing minutes treated as long distance, and no optional features.

- Level 2: 450 incoming & outgoing minutes per month, with 10% of outgoing minutes treated as long distance, two optional features (voice mail and call display), and 300 text messages per month.

- Level 3: 1,200 incoming & outgoing minutes per month, with 15% of outgoing minutes treated as long distance, full set of optional features, 300 text messages and 1 GB data usage per month.

- Level 4: Unlimited nationwide talk and text (no international calling included), voice mail and call display, and 2 GB data usage per month.