The Potential of a Less Expensive iPhone and the Pre-paid Market

In light of Apple being told its products are too expensive, a new wave of rumours claim the company is about to launch a cheaper, low-cost iPhone this year. Some claim it will sport a bigger display, some not, but the majority of the rumours claim Apple will use a plastic and metal chassis to reduce costs.

Looking back in time, we find that the cost of manufacturing (bill of materials, or BOM) of an iPhone has been in the $180 range for a while: The iPhone 3GS BOM was $178.96; iPhone 4 BOM, $178.45; and iPhone 4S BOM, $188. The iPhone 5 is the only exception, with a $199 BOM.

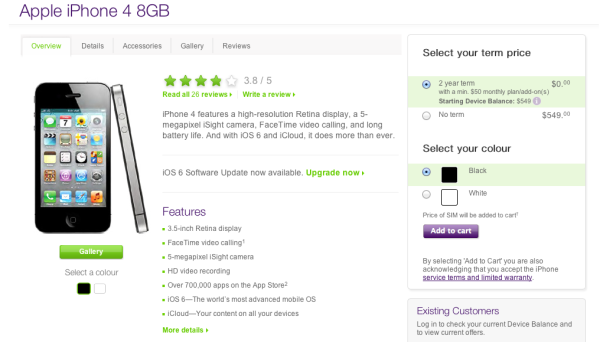

After three years of presence on the market, in 2012 the iPhone 3GS appeared as the first model offered for $0 subsidized price point. Also interesting, the iPhone 4 and iPhone 4S was offered as prepaid devices for $399 and $499 on Cricket, a wireless carrier in the US serving 6.2 million subscribers, while the same iPhone 3GS was offered for $225 in developing nations. Telus currently offers the iPhone 4 for $0 if you sign for a 2-year term.

Breaking with the iPhone 3GS into developing markets could make sense, as Apple has lowered its costs since the launch of this handset that still officially supports iOS 6.

While Apple has now experimented with the potential of the prepaid market through Cricket, it has historically avoided the prepaid approach. Although, as Jean-Louis Gassée, a former Apple executive points out in his Monday Note, Tim Cook constantly refers to Apple’s interest in the vast prepaid market segment. But it was all talk. Before Apple decides to enter into this segment, it needs to determine what sort of premium it can get for its low cost iPhone and how will this affect the rest of the product line.

Jean-Louis Gassée writes:

“So far, Apple has avoided the prepaid approach. When we give $199 to Verizon for a $650 iPhone, the $450 subsidy is an act of faith by the wireless carrier. The philanthropic organization assumes we’ll pay our bill every month for two years, by which time the carrier has recouped the subsidy. This is the postpaid world that Apple understands.

As for the pricetag, let’s assume that an iPhone LC would cost about $100 to manufacture — that’s half the cost of the basic iPhone 5. If we apply a 60% margin percentage — the same as today’s iPhone 5 — the unsubsidized iPhone LC would sell for $299.

That’s too high. Let’s try lower numbers: 50% margin gets us down to $199; 30% to $149. To get to the magic $99 unsubsidized retail, with an un-Apple 30% margin, the iPhone LC would need to be manufactured for less than $75, about one third of today’s iPhone 5.

And even $99 may not be low enough. Go to Amazon and look for prepaid cell phones. The first models start at $6.99 (not recommended, I tried one at $8.99 for my visiting Mother-in-Law, that was a mistake). Real smartphones running Android 2.2 start at $49.99 – today! For another $10 you get 2.3. The $80.73 Kyocera Rise runs the much more modern 4.0 (Ice Cream Sandwich) version. (I checked prepaid prices in other countries and the situation is similar.)

One thing is certain though: To offer support for the iPhone 3GS, Apple needed to trim features, and that includes the iPhone 4 as well. As Apple progresses with iOS, however, its architecture simply won’t be able to just trim features; it will need to cut it down. Considering that it is getting much better technology for lower prices than it originally paid for the iPhone 3GS, we tend to believe the iOS 7 3GS, the iPhone veteran, will likely be replaced with something newer that supports Apple’s latest operating system. Will Apple change tactics and add move toward pre-paid market? Maybe, but it would mark a change in trend.