Walmart Canada Launches Buy Now, Pay Later Option

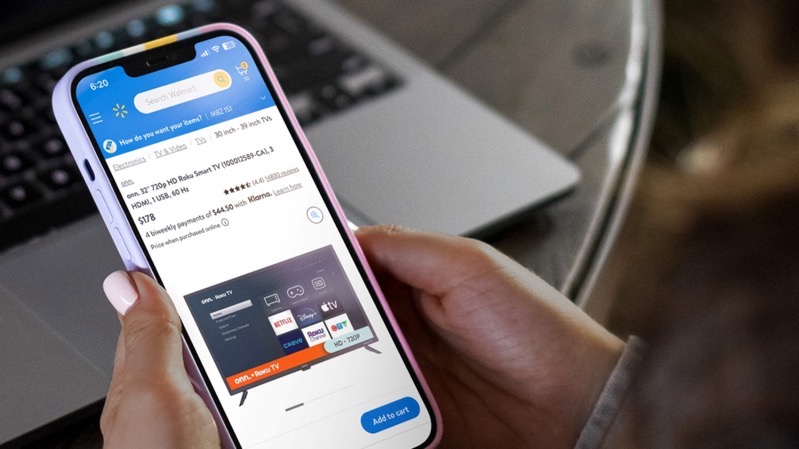

Walmart Canada has introduced an interest-free Buy Now, Pay Later (BNPL) payment option for its online customers. The new service is powered by Klarna and is available on Walmart.ca and through the Walmart Canada and Klarna mobile apps.

“Introducing Buy Now, Pay Later for shopping through Walmart.ca and our Walmart Canada app is the latest way we’re providing more payment choice and flexibility for customers,” said Laurent Duray, Chief E-commerce Officer, Walmart Canada, in a statement to iPhone in Canada on Monday.

The BNPL option comes as demand for such payment methods is surging in Canada, growing by 51.6% annually and expected to reach US $2.13 billion by the end of 2023, according to a report from Research and Markets.

The service allows customers to divide their purchases into four interest-free payments over a six-week period.

“We’re excited to welcome Walmart Canada to Klarna’s fast-growing global network of over 500,000 retail partners, offering Canadian consumers the convenient, interest-free payment alternatives they’re looking for,” said Steven Clarke, Head of Canada at Klarna, in a statement.

In terms of functionality, the new BNPL service allows customers to make four manageable, interest-free payments over a span of six weeks. There are no fees if payments are completed on schedule.

To help customers in sticking to their payment plans, Klarna sends out email reminders and offers in-app notifications. The service also includes budgeting tools within the Klarna app and restricts usage if payments are missed, aiming to prevent debt accumulation.

The signup process for a Klarna account is designed for user convenience as only basic info is needed. Once the account is set up, customers can select Klarna as their preferred payment method during the Walmart checkout process. Each purchase undergoes a real-time lending decision, ensuring that the customer’s credit score remains unaffected.

The service also offers clear payment schedules, enabling customers to better manage their cash flows by aligning payments with their pay cheque schedules. As for eligibility, the BNPL option is available for orders ranging between $50 and $4,000, although some restrictions apply. This allows customers to purchase a wide range of items, from home goods and electronics to apparel, under the new payment scheme.

The timing of this launch of Buy Now, Pay Later debuts ahead of Black Friday sales and the holidays in December.