Canadians Worrying Most About Inflation and Cost of Living: Survey

In a recent survey conducted by TD, both established and new Canadians express concerns about the financial landscape in 2024, with a particular focus on inflation and the cost of living.

Despite a higher household income among established Canadians, 36% feel less positive about their 2024 financial outlook, in contrast to 19% who feel more positive.

New Canadians, however, are seeing a more optimistic stance, with only 15% feeling less positive and 67% feeling more positive compared to 2023.

Moreover, new Canadians are more likely to seek regular professional financial advice, with 53% meeting with a qualified financial professional at least once a quarter, compared to 43% of established Canadians meeting them only once a year.

Additionally, new Canadians leverage budgeting tools more actively, with 66% using tools like spreadsheets or mobile apps, while only 29% of established Canadians adopt such tools.

“With another uncertain economic year projected, it isn’t surprising that many Canadians aren’t feeling optimistic about their finances,” notes TD’s Emily Ross.

Ross suggests that those with an optimistic financial outlook tend to take proactive steps, emphasizing the effectiveness of financial resolutions, budgeting, and regular consultations with financial professionals, especially during challenging times.

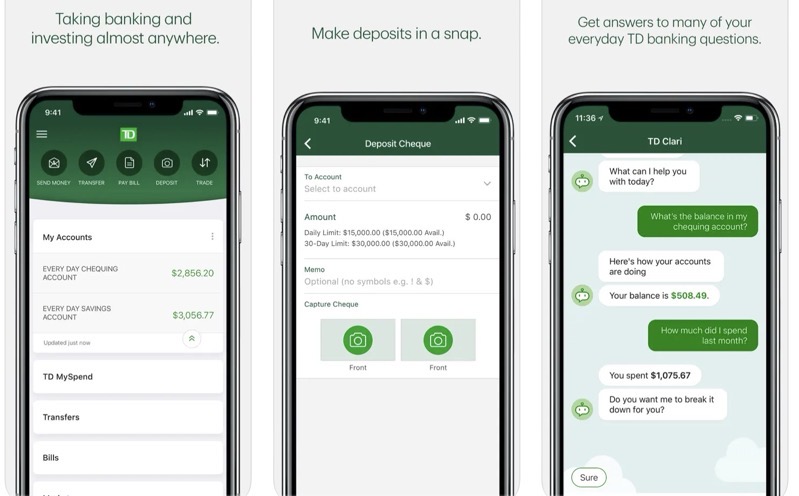

As Canadians contemplate their financial outlook, TD provides tools and resources to assist customers in establishing financial goals, creating personalized plans, and tracking progress.

Canadians can also use the TD MySpend app for better control of savings and spending, and professional financial insights.