Tesla Shares Soar After First Profit Posted in Two Years, Helped by Model 3

Tesla announced their Q3 earnings today and the company surprised Wall Street by posting its first quarterly profit in two years.

The company posted $6.82 billion in revenue, beating analysts’ expectations, plus net income of $312 million. The profit was the opposite of the year-ago quarter, when Tesla posted a loss of $619.4 million.

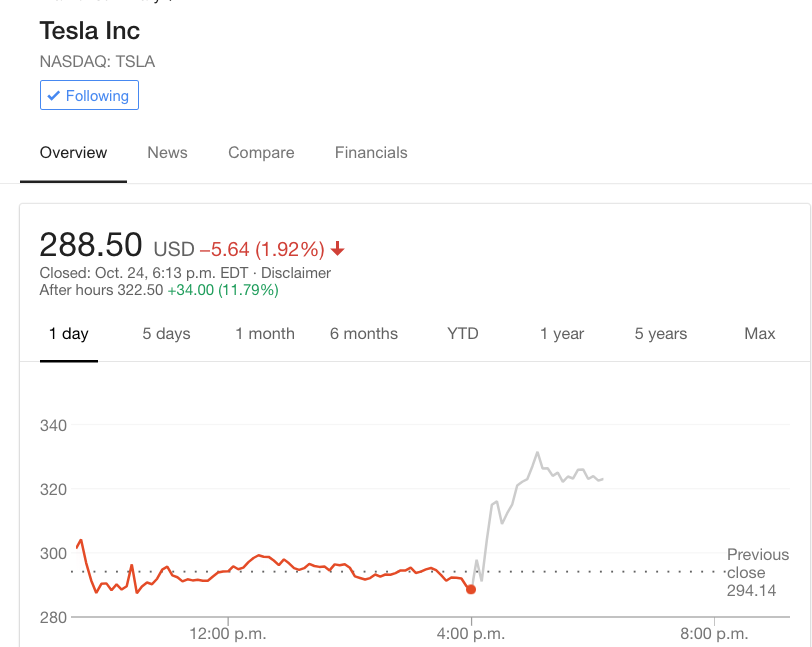

In after-hours trading, Tesla stock surged nearly 12 per cent.

Tesla CEO Elon Musk said in a letter to shareholders, “Q3 2018 was a truly historic quarter for Tesla. Model 3 was the best-selling car in the US in terms of revenue and the 5th best-selling car in terms of volume.”

The Model 3 is “attracting customers of both premium and non-premium brands, making it a truly mainstream product,” explains Musk.

The company’s profit was led by the popularity of its latest Model 3 sedan, which saw weekly production of nearly 4,300 units, just below the Tesla goal of 6,000 units per week (updated). Labour hours spent on Model 3 decreased by over 30 per cent compared to Q2, which Tesla says this level is now below its Model S and Model X for the first time.

Q3 saw 56,065 units of Model 3 delivered to customers. Of the 455,000 net reservations made for Model 3 as of August 2017, Tesla says less than 20 per cent have cancelled. As for Model S and X, 27,710 vehicles were delivered to customers.

Tesla says it opened 44 new Supercharger locations, now bringing its global total to 1,352. The company says there are over 11,000 Supercharging connectors and over 20,000 Destination Charging connectors worldwide.

Musk concludes his letter by saying, “we can’t thank you enough for your support. We would not have achieved this historic quarter without it.”

Last week, Tesla launched a mid-range Model 3, priced at $58,800 in Canada.