Netflix Sees Growth Amid Password Sharing Crackdown

Netflix has reported a rise in its quarterly subscriptions and revenue, amidst its ongoing efforts to curb password sharing. Despite beating earnings estimates, the streaming giant fell short of projected revenues, reporting an intake of $8.19 billion USD.

The platform reported an 8% rise in subscriptions in the second quarter and a 3% increase in revenue from $7.97 billion USD in the previous year. The company’s net income rose from $1.49 billion from $1.44 billion in the same quarter last year. The news saw Netflix’s stock drop 8% in after-hours trading on Wednesday.

The increase in subscribers came alongside a broader crackdown on password sharing in the U.S. Co-CEO Greg Peters stated that the full effect of this policy would not be seen for several quarters. “It’s not an overnight kind of thing,” he said on an earnings call.

“In part because of interventions that are applied gradually, and in part because some borrowers won’t immediately sign up for their own account, but will do so in the next month or three months or six months or maybe even longer down the line as we launch a title that they are particularly interested in,” said Peters, via CNBC.

Netflix noted that it expects an increase in revenue in the second half of the year, as the company sees the full benefits of paid sharing and the steady growth in their ad-supported plan. The company anticipates a 7% year-over-year rise in revenue for the third quarter, attributing the expected growth to an increase in average paid memberships.

Moreover, Netflix expects its efforts to curb password sharing to accelerate revenue growth in the fourth quarter, as advertising revenue increases.

“In Q2, we phased out our Basic ads-free plan for new and rejoining members in Canada (existing members on the Basic ads-free plan are unaffected),” said Netflix in its note to investors.

“We’re now doing the same in the US and the UK. We believe our entry prices in these countries – $6.99 in the US, £4.99 in the UK and $5.99 in Canada – provide great value to consumers given the breadth and quality of our catalog,” said the streaming giant.

The company reported an increase in its subscriber base following the rollout of its sharing policy. This growth follows the company’s first subscriber loss in over a decade in 2022. The company’s shares have climbed more than 60% this year, reaching a 52-week high in anticipation of this quarter’s growth.

While the exact breakdown of revenues from the ad-supported tier and the accounts affected by the new password policy are still unknown, the company reassured investors that it would use any additional funds to reinvest in the platform. Netflix stated that it would continue to “generate more revenue off a bigger base.”

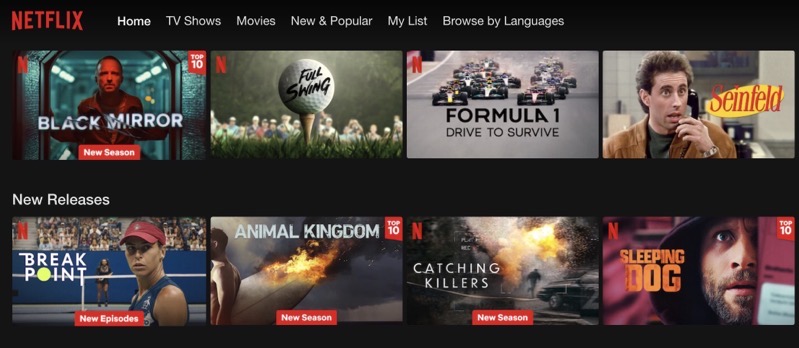

In addition to these measures, Netflix has also been exploring opportunities to acquire intellectual property to expand its content library.

Co-CEO Ted Sarandos said, “Our M&A activity would mostly be around IP that we could develop into great content for members. Traditionally, we’ve been very strong builders over buyers and that hasn’t changed.”

The company continues to grapple with the ongoing Hollywood writers and actors strikes, but maintains a strong content pipeline despite these industry challenges.