StatCan Says Cellphone Prices are Falling–But is it True?

The Canadian Telecommunications Association (CTA), formerly known as the Canadian Wireless Telecommunications Association (CWTA), which represents the country’s telcos, emphasized today the continued downward trend of telecom services pricing, according to fresh StatCan Consumer Price Index (CPI) data.

While inflation overall has been at 3.3% over the past 12 months according to the federal government, when it comes to telecom services, the CTA says prices “continue to decline”, pointing out the following:

- Cellular services declined 14.8% year-over-year, slightly higher than the 14.7% year-over-year decline reported last month;

- Prices for internet access services declined 3.8% year-over-year, up from the 3.4% YoY decline reported last month;

- Telephone services on the whole fell 11.1% year-over-year, and served as main downward contributor over this period, versus upward contributors like mortgage (+30.6%), electricity (+11.7%) and meat (+7.7%)

A CTA spokesperson also pointed out that “StatCan CPI data going back to 2021 shows cellular service prices have declined 18.6% over the past two years, while the overall consumer price index has increased 11.1%.”

Now, it all sounds fine and dandy—but is StatCan data actually true? Are telecom prices falling as stated? While StatCan says wireless prices are falling—they are basing this on the price of data buckets and tracking the cost of dollars per gigabyte, as confirmed by a spokesperson to iPhone in Canada.

We’ve seen wireless carriers increase data buckets and dole out free data bonuses, which can easily skew the price of data. But that price of data doesn’t reflect your average monthly bill.

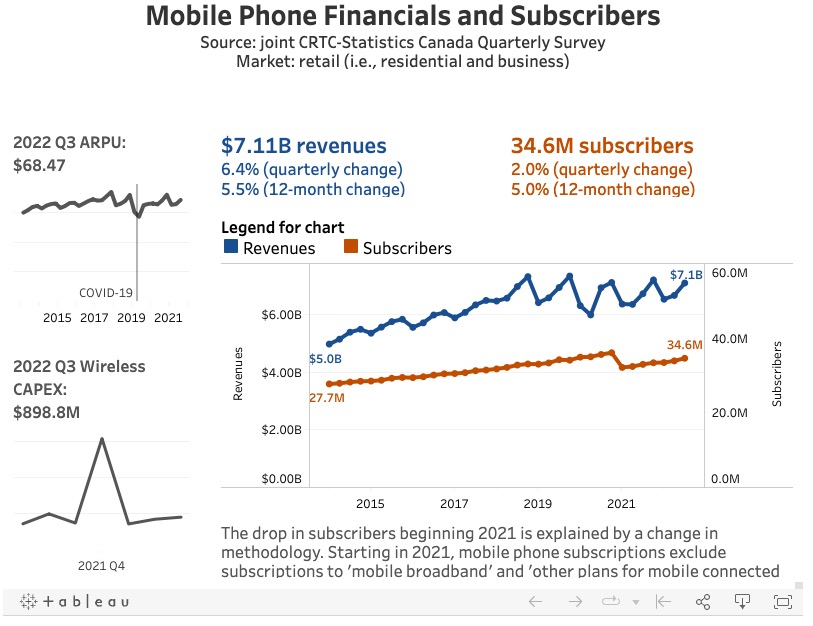

According to the CRTC’s mobile wireless trends page, which was last updated for 2022 Q3 (wake up, CRTC), when it comes to mobile phone financials and subscribers, consisting of residential and business, it paints a different picture. The 2022 Q3 average revenue per user (ARPU) metric stands at $68.47 per month.

Check out the latest ARPU stats from Q2 2023 from our major telecoms:

- Rogers: $56.79 (this decreased because of lower-priced plans from Shaw Mobile joining)

- Telus: $58.80 (increase of $1.06 YoY; thanks to increase in roaming revenues)

- Bell: $59.16 (down $0.01 YoY)

Update: To be clear, ARPU doesn’t necessarily reflect prices, but what consumers are willing to pay. The question remains–are monthly prices falling alongside the price per gigabyte? Or are data buckets just increasing?

For anyone subscribed to a 5G plan from the ‘Big 3’, they have remained constant and are priced at $65 or higher per month, even from their flanker brands Koodo and Virgin Plus. You can only get a lower-priced 5G plan from an online-only brand like Telus-owned Public Mobile (starting at $45/month).

Quebecor’s takeover of Freedom Mobile and its debut of 5G nationwide plans has caused some competition lately, as Virgin Plus and Koodo now offer 5G as well (Fido has yet to match).

So the next time the feds are announcing a decrease in wireless prices based on CPI data, note that it’s based on dollar-per-gigabyte pricing and not the price of monthly average bills. Have you seen your monthly cellphone bill decrease over the past month?